A Guide to Small Business Financial Reporting

Financial reporting for a small business is really just about taking all the day-to-day transaction data and putting it into a format that tells a story. Think of it as translating your sales receipts, invoices, and bank statements into a few key documents—like an income statement or a balance sheet. These reports are crucial because they show you if you're profitable, how healthy the business is financially, and where your cash is actually going. Without them, you're essentially flying blind.

Why Financial Reporting Is Your Business Roadmap

I've seen so many small business owners treat financial reports as a chore—something you only do for taxes or a bank loan. But that perspective completely misses the point. These reports aren't just dusty old records. They're your business's roadmap, showing you where you've been, where you are right now, and most importantly, where you're headed.

Spending too much time on Excel?

Elyx AI generates your formulas and automates your tasks in seconds.

Try for free →It's like this: you wouldn't set off on a cross-country trip without a map or GPS, right? Trying to grow a business without clear financial reports is the same thing. The numbers tell the story of your business in a language everyone understands.

And that story matters. Small businesses are a huge part of the economy, and good financial management is what separates the successful ones from the ones that struggle. For instance, in 2025, an estimated 65.3% of small businesses are profitable, and a solid 9% bring in over $1 million annually. All told, the 32.9 million small businesses in the U.S. generate about $40.2 trillion in revenue. Success on that scale doesn't happen by accident; it's built on a deep understanding of financial data. You can dig into more of these trends in this overview of small business statistics.

Beyond Compliance to Strategic Insight

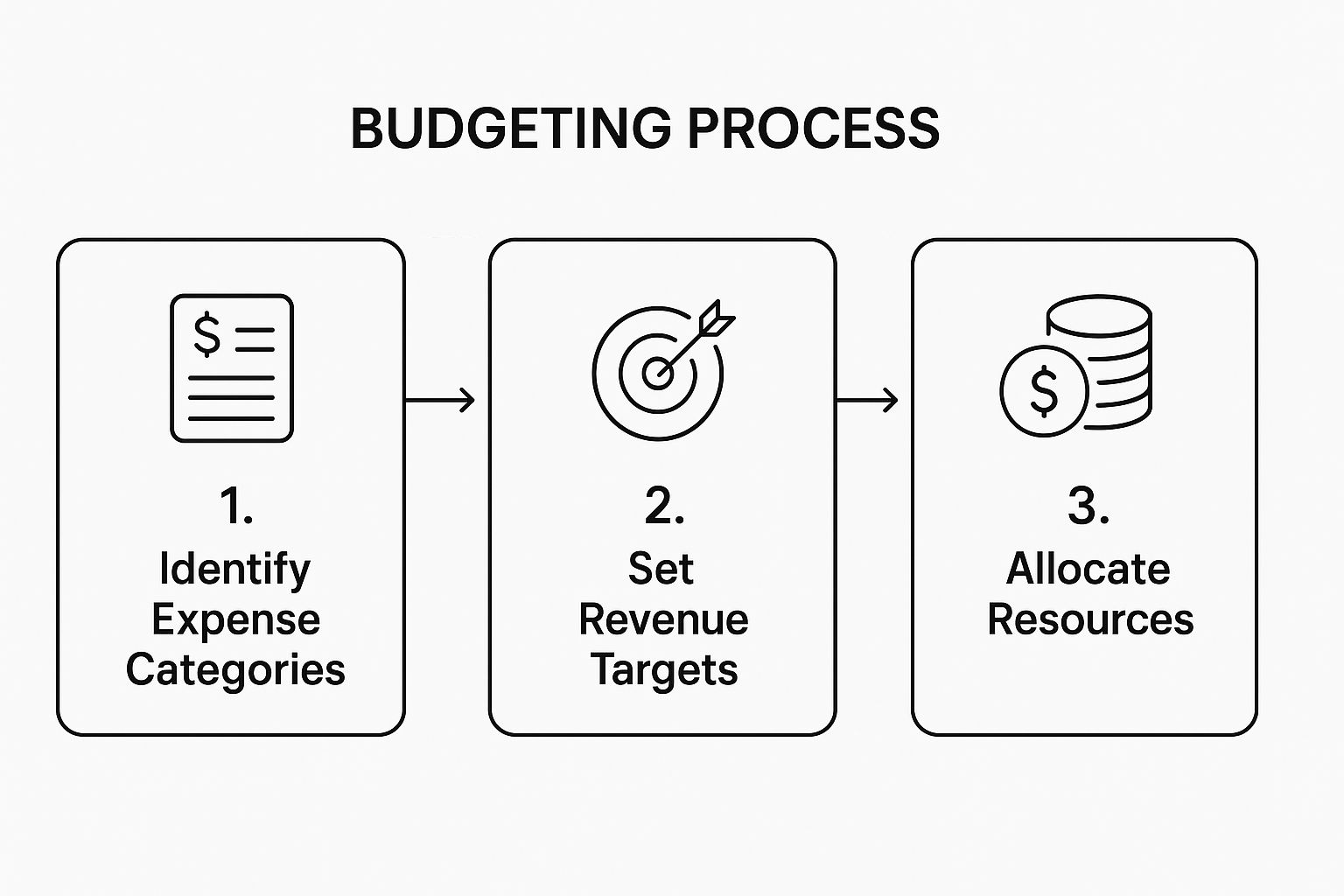

The real magic happens when you stop seeing reporting as just a compliance task and start using it for strategic thinking. It’s about asking smarter questions and letting your own data give you the answers. Instead of just seeing a long list of expenses, you can start to identify which costs are creeping up and figure out why. Instead of just looking at your total sales, you can pinpoint which products or services are actually your most profitable.

This kind of strategic approach helps you sidestep common business-killers:

- Preventing Cash Flow Crises: A good cash flow statement can signal a potential cash crunch months ahead of time. That gives you a chance to secure a line of credit or trim spending before it becomes an emergency.

- Informing Pricing Strategies: Your income statement shows you your true profit margins. This is how you figure out if your pricing actually covers all your costs and leaves you with a healthy profit.

- Identifying Growth Opportunities: When you look at trends over time, you can spot clear opportunities to expand, launch a new service, or push into a new market.

At its core, financial reporting transforms abstract numbers into actionable intelligence. It's the mechanism that turns raw data from sales, expenses, and assets into a clear narrative about your operational health and future potential.

Making Sense of the Core Reports

It's easy to get bogged down by terms like "balance sheet" and "income statement." I get it. Let’s quickly break down the three reports every business owner absolutely needs to know. Each one gives you a different piece of the puzzle, and when you put them together, you get the full financial picture.

To make it simple, here's a quick summary of what each core report does.

Core Financial Reports for Small Businesses

| Report Type | What It Shows | Key Question Answered |

|---|---|---|

| Income Statement | Your company's profitability over a specific period (e.g., month, quarter, year). It lists revenues and subtracts expenses to show your net profit or loss. | "Is my business making money?" |

| Balance Sheet | A snapshot of your company's financial health at a single point in time. It shows what you own (assets) and what you owe (liabilities), along with owner's equity. | "What is my business worth right now?" |

| Cash Flow Statement | The movement of cash into and out of your business over a period. It tracks cash from operations, investing, and financing activities. | "Where is my cash coming from, and where is it going?" |

Getting a handle on these three pillars is the first real step toward financial fluency for your business.

Throughout this guide, we're going to walk through how to build these exact reports in Excel. But more importantly, we’ll show you how to use AI tools like Elyx.AI to automate the entire process. This gets you out of the weeds of manual data entry so you can focus on what you're best at: making smart, confident decisions to move your business forward.

Organizing Your Financial Data in Excel

Let's be honest: even the most advanced financial report is useless if it’s built on a messy foundation. Before you even touch a tool like Elyx.AI or start dreaming of automated income statements, you have to bring some order to the chaos of your financial data. This is, without a doubt, the most important part of small business financial reporting. Get this right, and everything else falls into place.

Think of it like getting your kitchen ready before you cook a big meal. You wouldn't just start tossing ingredients into a pan without prepping them first. Organizing your financial data in Excel is your mise en place—it's the prep work that guarantees a good result. Your goal is to create a single, reliable source of truth that's clean, consistent, and ready for analysis.

First things first, you need to gather all the puzzle pieces. This usually means collecting:

- Bank and Credit Card Statements: These are your primary records of money coming in and going out.

- Invoices and Receipts: The paper trail for all your sales and expenses.

- Payroll Records: All the details on wages, taxes, and employee benefits.

- Loan Agreements: Crucial information on your debts and interest payments.

Once you have everything in front of you, the real work of standardizing it in Excel begins.

How to Structure Your Data for Clarity

One of the biggest mistakes I see small business owners make is dumping all their numbers into one giant, overwhelming spreadsheet. A much better approach is to use separate, well-defined tables. I always recommend creating dedicated tabs within your Excel workbook for different types of data.

For a new workbook, you could start with three essential tabs:

- Transactions: This will be your master log of every single financial event.

- Income Details: A focused look at all your revenue sources.

- Expense Details: A categorized breakdown of every business cost.

This simple separation keeps things from getting tangled and makes it much easier to build your financial statements down the road. When you eventually feed this clean data into an AI tool, it can immediately understand the context instead of trying to guess what each column represents.

Building Your Core Transaction Table

Your transaction log is the heart of your financial record-keeping. Think of it this way: every row is a single transaction, and every column is a key piece of information about it. Consistency is everything here.

Here’s a straightforward, effective structure for your main transaction table that has worked for countless businesses:

| Date | Description | Category | Sub-Category | Amount | Type |

|---|---|---|---|---|---|

| 2024-10-01 | Payment from Client A | Income | Service Revenue | $1,500.00 | Credit |

| 2024-10-02 | Office Supplies Store | Expense | Office Supplies | -$75.50 | Debit |

| 2024-10-03 | Monthly Software Fee | Expense | Software & Tools | -$49.99 | Debit |

A few hard-won tips from my own experience:

- Standardize Your Dates: Always, always use the same format (like YYYY-MM-DD). This prevents sorting headaches and makes filtering by date range a breeze.

- Use Consistent Names: Don't write "Software" in one row and "SaaS Subscription" in another. Create a simple key for your categories and stick to it religiously.

- Separate Debits and Credits: While you can use positive and negative numbers in a single "Amount" column, adding a separate "Type" column (Credit/Debit) can make writing formulas like SUMIF much, much simpler later on.

The discipline you build during data entry has a direct impact on how much you can trust your financial reports. Taking a few extra seconds to categorize a transaction correctly will save you hours of frustrating troubleshooting.

The Real Power of Categorization

This is where your raw numbers start to tell a story. Categorization is how you’ll eventually see that you spent $500 on software last month or earned $5,000 from a specific service line. Without it, you just have a meaningless list of transactions.

I suggest starting with broad categories and then getting more specific with sub-categories. This kind of hierarchy is incredibly useful for analysis.

For example, your expense categories might look like this:

- Marketing & Advertising

- Social Media Ads

- Content Creation

- Email Marketing Service

- Operations

- Software & Tools

- Office Supplies

- Utilities

- Personnel

- Salaries & Wages

- Contractor Payments

- Payroll Taxes

This structured approach doesn't just make your life easier; it's exactly what AI tools need to work their magic. When you ask Elyx.AI to "show me a breakdown of my marketing spend," it knows exactly what to pull because you've already done the foundational work. This single step transforms your spreadsheet from a simple ledger into a dynamic database, fully prepared for powerful small business financial reporting.

Weaving Your Financial Story with Excel Formulas

Alright, your data is clean, organized, and sitting nicely in structured tables. Now for the really satisfying part: making Excel do the hard work for you. This is where you graduate from basic =SUM() functions and start transforming those rows of transactions into living, breathing financial reports that tell a story.

We're not just aiming for a one-off calculation here. The goal is to build a reusable, dynamic template. Imagine an Income Statement, Balance Sheet, and Cash Flow Statement that automatically update as soon as you log a new transaction. That’s how you get back hours of your life every single month.

Crafting a Dynamic Income Statement with SUMIF

Your Income Statement, or P&L, is the best place to start. It answers the most critical question in business: "Are we making money?" To build it, you’ll pop open a new tab, name it "Income Statement," and lay out the basic skeleton with your revenue and expense categories.

But instead of punching in numbers with a calculator, you’ll use the SUMIF formula to pull data directly from your "Transactions" tab. This nifty function adds up numbers from one column that meet a condition in another.

Let's say you want to total up all your "Service Revenue." In the corresponding cell on your Income Statement, you'd type:

=SUMIF(Transactions!C:C, "Service Revenue", Transactions!E:E)

Here's what that formula is telling Excel to do:

Transactions!C:C: Look through the entire 'Category' column on my Transactions tab."Service Revenue": Find every cell that says "Service Revenue."Transactions!E:E: For every match you find, grab the corresponding number from the 'Amount' column and add it all up.

Apply this same logic for every single revenue and expense line, and you’ve just built a report that recalculates on its own. This is your first huge win in the automation game.

Assembling the Balance Sheet with VLOOKUP

Next up is the Balance Sheet, which gives you a snapshot of your company's financial health by laying out your Assets, Liabilities, and Equity. While SUMIF is great for things like totaling your cash accounts, other items—like specific loan balances—need a different tool.

Enter VLOOKUP. This formula is perfect for fetching a specific piece of information from a table. Let's say you keep a separate tab called "Loans" that lists each loan, its outstanding balance, and other key details.

On your Balance Sheet, you can use VLOOKUP to pull the exact, up-to-the-minute balance for a specific loan. To grab the balance for your "SBA Loan," the formula would be:

=VLOOKUP("SBA Loan", Loans!A:D, 4, FALSE)

This tells Excel to find "SBA Loan" in your 'Loans' table and return the value from the 4th column in that row. Using VLOOKUP eliminates the risky habit of copy-pasting, which is where so many reporting errors are born.

The real magic of using formulas like

SUMIFandVLOOKUPis that you create a live, unbreakable link between your raw data and your finished reports. When your transaction log changes, the reports change instantly. You're always making decisions with the freshest numbers possible.

This level of precision is absolutely vital. A recent survey from the U.S. Chamber of Commerce shows small business owners are cautiously optimistic. While about 65% expect revenues to grow, this is down from 73% in the previous quarter. With only 34% of owners rating the economy as "good," having razor-sharp financial reports isn't just nice—it's essential for navigating what's ahead.

Unlocking Quick Insights with PivotTables

PivotTables are, without a doubt, one of Excel's most powerful tools, but they have a reputation for being intimidating. Don't believe the hype. They are the single fastest way to summarize a mountain of data with a few drag-and-drops.

Ever wanted a quick breakdown of your spending by category, month-over-month? Doing it manually is a soul-crushing exercise in filtering and summing. A PivotTable does it in about ten seconds.

Here's how to create a quick expense summary:

- First, select your entire "Transactions" data table.

- Next, head to the Insert tab and click PivotTable.

- In the PivotTable fields pane, drag 'Category' to the Rows box.

- Then, drag 'Amount' to the Values box.

- Finally, drag 'Date' to the Columns box (Excel is smart and usually groups this by month for you).

Boom. You now have a perfectly summarized report showing exactly what you spent on what, and when. This not only makes financial reporting less of a chore but also gives you a fantastic tool for on-the-fly analysis whenever a question pops into your head.

Once you’ve mastered these formulas and tools, you’ll have a seriously robust reporting system. But this is just the foundation. To see how you can take this to an even higher level, check out our guide on automating Excel reports with AI, where we show how tools like Elyx.AI can build these reports and write the formulas for you.

How AI Can Automate Your Reporting Workflow

So, you’ve wrestled with your spreadsheets and built some pretty smart reports. That’s a massive win for any small business. But what if you could sidestep most of the tedious formula-writing and data-wrangling altogether? This is where the real magic happens, shifting your process from painstakingly manual to almost instantly automated.

Imagine having an expert right inside Excel, a copilot that understands what you’re trying to achieve and just does it for you. That’s exactly what tools like Elyx.AI are all about. They let you use plain English to get powerful results, turning what used to be an hour-long headache into a few seconds of typing.

Instead of fighting with nested formulas or trying to remember how to configure a PivotTable, you can just ask for what you need. It completely changes how you interact with your own financial data.

From Manual Clicks to Simple Conversations

The fundamental shift is moving from "doing" to "asking." When you have an AI assistant in Excel, it handles the technical side of things, freeing you up to think about the bigger picture. You no longer have to recall the exact syntax for a VLOOKUP or the five steps it takes to create a decent-looking chart.

You can just ask things like:

- “Clean up this transaction data. Standardize the date formats and get rid of any duplicate rows.”

- “Write me a formula to calculate the variance between the 'Actual' and 'Budget' columns.”

- “Create a bar chart showing my total revenue per month for the last quarter.”

This conversational approach makes deep data analysis accessible to everyone, not just Excel whizzes.

The real value here is that AI transforms you from a data technician into a business strategist. Your mental energy shifts from battling spreadsheet mechanics to actually interpreting what the numbers mean for your business.

For instance, a small coffee shop owner could type, "Show me a monthly trend of my top five expense categories." In moments, Elyx.AI could spit out a clean, insightful chart. This instantly shows if the cost of coffee beans is creeping up or if packaging costs are getting out of hand—insights that might have taken an hour of manual work to uncover.

Practical Use Cases for AI-Powered Reporting

Let's get practical. How does this actually play out in a typical small business? The possibilities are endless, but here are a few real-world examples that deliver immediate value by saving time and uncovering deeper insights.

Generating Variance Analysis Reports

Comparing what you actually spent against your budget is a cornerstone of financial management. Manually, this means lining up data and writing formulas for every single line item to see the difference.

With an AI assistant, you just highlight the data and ask, "Create a new column that shows the percentage variance between my actual spending and my budget." The tool does the rest, instantly flagging where you’re over or under.

Creating Revenue Trendline Charts

Visualizing your financial trends is the fastest way to spot growth or catch problems early. Instead of messing with chart settings, you can make a simple request: "Generate a line chart of my monthly revenue for the past year and add a trendline." This gives you an immediate visual on your growth trajectory, which is invaluable for making smarter forecasts.

Flagging Unusual Transactions

Auditing your own books for errors or oddities can feel like searching for a needle in a haystack. An AI can be your vigilant assistant. A command like, "Highlight any expense transaction over $1,000 in the 'Office Supplies' category" automates anomaly detection, pointing you directly to what needs a closer look.

The time savings from these kinds of tasks are significant, as you can see when you compare the old way with the new.

Manual Excel Tasks vs. AI Automation

| Reporting Task | Manual Excel Method | AI Command Example | Advantage |

|---|---|---|---|

| Data Cleaning | Sort, filter, use TRIM, PROPER, and "Remove Duplicates" tool. |

"Standardize state names to 2-letter codes and remove extra spaces." | Saves 15-30 minutes of tedious manual cleanup per report. |

| Variance Calculation | Write formulas like =(C2-B2)/B2 and drag down for each row. |

"Calculate the percentage variance between 'Actuals' and 'Budget'." | Eliminates formula errors and provides instant results. |

| Trend Charting | Select data, insert chart, format axes, add labels, and insert a trendline. | "Create a line chart of monthly sales with a 3-month moving average." | Generates a presentation-ready visual in seconds. |

| Finding Anomalies | Manually sort and scan data or build complex conditional formatting rules. | "Highlight all payments to vendors we haven't paid in 6 months." | Automates auditing and helps spot potential fraud or errors. |

This table clearly shows how AI shifts the workload, freeing you from repetitive tasks to focus on strategy.

Automating these processes is becoming more important than ever. New accounting standards, like ASC 842 for leases and ASC 606 for revenue, have added layers of complexity that can be tough for small teams to manage. AI tools can help you stay compliant by handling the intricate calculations automatically.

To see more examples of how this technology can be applied, check out our guide on financial reporting automation. By letting an AI copilot handle the heavy lifting, you're not just saving time—you're adopting a smarter, more strategic way to manage your business's finances.

Turning Financial Reports into Smart Decisions

Let's be honest, a perfectly crafted report is just a document until you do something with it. The real magic happens when you use it to make a decision. This is where all that hard work organizing your data and automating reports starts to pay off, moving you from simply ticking compliance boxes to genuinely strategic management. The goal is to connect the numbers on the screen to real-world actions that build a more profitable and resilient business.

Interpreting your reports is less about complex accounting theory and more about applying good business sense. It’s about asking the right questions and knowing where to look for the answers. Suddenly, you can get clarity on those tough questions that keep you up at night: Can we actually afford a new hire? Is this product line really profitable? Do we have enough cash to ride out a slow season?

This analytical step has never been more critical. A recent analysis from the 2024 Small Business Credit Survey pointed out that for the first time since 2021, more firms are reporting revenue decreases than increases. That signals some serious financial pressure out there. Having a clear-eyed view of your own numbers isn't just nice—it's essential for survival and growth. You can read more about these trends in small business finance for broader context.

Key Ratios That Tell the Real Story

Think of financial ratios as your secret decoder ring. Instead of getting bogged down in a sea of raw numbers, these simple calculations give you quick, digestible metrics to see what’s really going on under the hood. You don’t need to track dozens of them; focusing on a few vital ones will make all the difference.

- Gross Profit Margin: This one tells you how much profit you’re making from each sale before factoring in overhead. If this number is shrinking, it’s a warning sign. Your material costs might be creeping up, or maybe it’s time to rethink your pricing strategy.

- Current Ratio (Assets / Liabilities): This is a classic test of your financial health. It answers one simple question: "Can we pay our short-term bills?" A ratio below 1.0 is a red flag that cash flow could get uncomfortably tight.

- Net Profit Margin: The bottom line. This shows you what percentage of revenue is left after every single expense is paid. It's the ultimate measure of your company’s overall profitability.

The real power comes from tracking these ratios month over month. A one-time dip in your profit margin could be a fluke, but a three-month slide is a trend—a problem that needs your immediate attention. Better yet, you can use Elyx.AI to automatically calculate and chart these key ratios right inside your report.

From Interpretation to Actionable Steps

Finding an insight is one thing; doing something about it is everything. Your small business financial reporting should lead directly to your to-do list.

Here’s a practical look at how to translate what you see in your reports into concrete business decisions:

| If Your Report Shows… | It Might Mean… | Your Next Action Could Be… |

|---|---|---|

| Declining Gross Profit Margin | Your cost of goods is climbing, or your prices aren't keeping pace. | Renegotiate with your suppliers or test a small price increase on a popular product. |

| High and Rising Operating Expenses | Your overhead (software, marketing, rent) is growing faster than your revenue. | Perform an expense audit. Ask yourself, "Are we getting a real return on every subscription we pay for?" |

| Weakening Current Ratio | You have more short-term bills coming due than you have liquid cash to cover them. | Get more aggressive about collecting outstanding invoices or look into a short-term line of credit as a safety net. |

| One Product Line Has Low Margins | A specific service or item is a lot less profitable than you assumed. | Figure out if you can reduce its direct costs, bundle it with a higher-margin offering, or even consider discontinuing it. |

The ultimate goal of a financial report isn’t just to see where you stand. It’s to give you the clarity and confidence to decide where you’re going next. Every number is a clue that can guide your strategy.

When you consistently review these reports and ask "So what?", you fundamentally change the game. You stop reacting to financial surprises and start proactively shaping your company’s future. The formulas are just the language; the real value is in the story they tell and the smart decisions they help you make. For a closer look, you can explore our detailed guide on the most important Excel financial formulas for your business.

Got Questions About Financial Reporting? We've Got Answers.

Jumping into financial reporting for your small business can feel like learning a new language. It's totally normal to have questions. Let's walk through some of the most common ones I hear from entrepreneurs, breaking them down into simple, practical answers.

How Often Should I Be Looking at My Financial Reports?

For keeping your finger on the pulse of the business, running your key reports monthly is the way to go. Think of it as your regular check-in. It’s frequent enough to catch trends as they're happening, get ahead of cash flow issues, and tweak your strategy before a small hiccup turns into a major headache.

Of course, you'll still need those quarterly and annual reports. Those are usually for the big stuff—filing taxes, updating investors, or applying for a business loan. The monthly reports are for you; the quarterly and annual ones are for everyone else.

Can I Really Do My Own Financial Reporting?

You absolutely can. Many small business owners handle their own reporting just fine, especially with the tools available now. If you're comfortable in Excel, adding an AI assistant like Elyx.AI to the mix can be a game-changer. It takes the pain out of tricky formulas and tedious data cleanup, making powerful reporting accessible even if you're not an accountant.

That said, don't feel like you have to be a lone wolf. Bringing in a professional accountant for tax season, annual reviews, or when you're making a big financial move is always a smart investment. They provide that expert backstop, ensuring everything is accurate and compliant.

The best setup I've seen is a hybrid approach. You manage the monthly reporting to stay connected to your business's daily health, and an accountant provides oversight and handles the critical compliance work.

Which Financial Report Is the Most Important?

This is the million-dollar question. While you need all three core reports—the Income Statement, Balance Sheet, and Cash Flow Statement—for a complete picture, if I had to pick one for survival, it's the Cash Flow Statement.

Why? Because profit isn't the same as cash in the bank. An income statement can show you're profitable, but the Cash Flow Statement tells you if you actually have the money to make payroll next week. It tracks the real dollars moving in and out of your business, which is everything for managing your day-to-day operations and avoiding a cash crunch.

How Do I Make Sure My Financial Data Is Accurate?

Accuracy really comes down to consistency. It starts with creating firm rules you never break. Use a dedicated business bank account and credit card—no exceptions. Keep a digital paper trail for every single transaction, no matter how small.

The single most effective habit for guaranteeing accuracy is performing a monthly reconciliation. This just means you sit down and systematically compare your own records (your Excel sheet) to your official bank statements line by line. It's the best way to catch everything from duplicate charges to missed payments. A clean, disciplined data entry process, like the one we covered earlier, makes this whole thing much, much easier.

We've covered some common ground here, but you might have more specific questions. Here's a quick look at a few other frequent queries.

Common Questions on Small Business Financial Reporting

| Question | Answer |

|---|---|

| What's the difference between cash and accrual accounting? | Cash accounting recognizes revenue/expenses when money changes hands. Accrual accounting recognizes them when they're earned/incurred, regardless of payment. Most small businesses start with cash basis. |

| Why is my profit high but my bank account is low? | This classic scenario is often due to accrual accounting, unpaid customer invoices (accounts receivable), or large, recent cash purchases like inventory or equipment. The Cash Flow Statement will reveal the answer. |

| What tools do I need besides Excel? | At a minimum, you need a good system for receipt capture (even a dedicated folder on a cloud drive works) and a business bank account. Accounting software like QuickBooks or Xero are popular alternatives to a pure Excel system. |

| How can I automate this process? | Automation is key. Tools like Elyx.AI can automate report generation directly in Excel. Setting up bank feeds in accounting software or using rules to auto-categorize transactions also saves a ton of time. |

Hopefully, this gives you a clearer path forward. The goal isn't just to create reports, but to build a system that gives you confidence in your numbers and your decisions.

Ready to stop wrestling with spreadsheets and start getting immediate insights from your data? With Elyx.AI, you can automate your financial reporting, clean up your data with simple English commands, and turn your numbers into your next smart move.

Transform Your Excel Workflow with Elyx.AI Today

Reading Excel tutorials to save time?

What if an AI did the work for you?

Describe what you need, Elyx executes it in Excel.

Try 7 days free