Enhance Business Efficiency with Financial Reporting Automation

At its core, financial reporting automation is about using technology to take over the heavy lifting involved in creating and sharing financial reports. It’s a lot like hiring a brilliant conductor for your finance orchestra. Instead of each musician fumbling with their own sheet music, the conductor ensures every data source plays in perfect harmony, producing accurate and timely financial statements without constant micromanagement.

From Manual Chaos to Automated Clarity

Think about your finance team as that orchestra. In a typical manual setup, each analyst is like a musician scrambling to find their own sheet music (spreadsheets), tune their instrument (clean up the data), and wait for a cue. The whole process is sluggish, riddled with potential mistakes, and makes it incredibly difficult to produce a cohesive symphony—your financial reports.

Now, bring in financial reporting automation. This is your conductor. It doesn't replace your talented team; it empowers them. This technology steps in to automatically pull together, process, and present financial data in a clear, consistent way.

Spending too much time on Excel?

Elyx AI generates your formulas and automates your tasks in seconds.

Try for free →

This automation becomes the central hub that connects all your separate systems—your ERP, CRM, and even bank accounts. Forget about the days of manually exporting and trying to stitch data together in a massive spreadsheet. The system does that for you, freeing up your team from the tedious, error-prone tasks that always bog down the month-end close.

Core Functions of Automation

So, what does this automation actually do? It handles a few key functions that turn messy, raw data into something you can actually use for strategic decisions. These systems are designed to manage the entire reporting cycle, from grabbing the initial numbers to sending out the final report.

Here’s what it typically handles:

- Data Aggregation: It automatically gathers information from all your different sources and puts it into a single, unified view.

- Data Processing: The system cleans, standardizes, and reconciles all that data to make sure it's consistent and reliable.

- Report Generation: It uses predefined templates to create standard reports like income statements, cash flow statements, and balance sheets.

- Compliance Checks: It helps you stay on the right side of regulations by making sure your reports meet standards like IFRS or GAAP.

By taking over these core tasks, automation allows your finance department to stop being historical record-keepers and start being forward-looking strategic partners for the business.

This fundamental shift is why the market is growing so rapidly. The financial reporting software market, currently valued at USD 14.60 billion, is expected to skyrocket to USD 31.01 billion by 2030. This isn't just a fleeting trend; it shows a real, growing demand for tools that deliver real-time insights and automated compliance. You can read the full research about financial reporting market growth to see just how significant this shift is.

The True Benefits of Automating Financial Reports

Let's move past the buzzwords. When we talk about automating financial reports, we're not just talking about saving a few hours here and there. We're talking about a fundamental shift in how your finance department operates and the value it brings to the entire business.

The most obvious win is drastically cutting down on human error. We've all been there—staring at a spreadsheet late at night, trying to find that one transposed number or misplaced decimal that’s throwing everything off. Manual data entry is a minefield of tiny mistakes that can snowball into major reporting headaches.

Automation essentially acts as a tireless, detail-obsessed assistant. It pulls, validates, and reconciles data based on rules you set, delivering reports you can actually trust. That confidence is invaluable, both for internal decision-making and for meeting compliance standards without breaking a sweat.

Reclaiming Time and Empowering Your Team

Think about the hours your team sinks into mind-numbing, repetitive tasks. It’s all the copying and pasting between systems, the manual formatting, and the routine generation of the same monthly reports. In fact, research suggests that most businesses are on track to automate a quarter of their processes, and accounting is leading the charge. This isn't about replacing people; it's about freeing up your sharpest minds for work that matters.

Instead of just reporting on what happened last month, your team can start analyzing why it happened and modeling what could happen next. This is the shift from historical record-keeping to forward-looking strategic partnership.

When automation takes over the grunt work, your finance professionals finally get the breathing room they need. They can dig into performance trends, build more sophisticated forecasts, and provide the kind of nuanced insights that leadership teams crave. They become true strategic partners.

From Reactive Reporting to Real-Time Foresight

The single biggest change is the ability to break free from old, stale data. Traditional reporting cycles mean that by the time a report lands on a manager's desk, it’s already a snapshot of the past. In today’s market, making decisions based on last week’s numbers is like driving while looking in the rearview mirror.

Financial reporting automation changes the game by delivering insights as they happen. Dashboards update in real-time, giving you a live, accurate view of your company’s financial pulse. This immediacy lets you respond to challenges and opportunities proactively, not reactively.

To see just how different the two approaches are, let's compare them side-by-side.

Comparing Manual vs Automated Financial Reporting

The table below breaks down the day-to-day reality of manual processes versus what becomes possible with automation. It’s a clear picture of how technology can completely change the nature of the work.

| Activity | Manual Process | Automated Process |

|---|---|---|

| Data Collection | Manually exporting from multiple systems and compiling spreadsheets. | Automatically pulling real-time data from all integrated sources. |

| Error Checking | Tedious, line-by-line manual review and reconciliation. | Automated validation and flagging of discrepancies instantly. |

| Decision Speed | Decisions based on outdated, historical information. | Proactive, strategic decisions based on up-to-the-minute data. |

Ultimately, having immediate access to reliable financial data turns your finance department from a cost center into a strategic command center. It gives your entire organization the agility to pivot faster, grab opportunities before competitors do, and navigate uncertainty with genuine confidence.

Core Technologies Behind Finance Automation

To really get what makes financial reporting automation tick, you need to look under the hood. It’s not just one single piece of magic software. Instead, think of it as a team-up between two powerful technologies: one that acts as a tireless "digital workforce" and another that serves as the strategic "digital brain."

This digital workforce is driven by Robotic Process Automation (RPA). Essentially, these are software “bots” designed to mimic human actions for repetitive, rule-based digital tasks. Picture an employee who can pull data from emails, log into your accounting software, and reconcile numbers across different systems around the clock—without ever making a typo or needing a coffee break.

RPA is the brute force of automation. It’s perfect for those predictable, high-volume jobs like extracting invoice data, moving files, or populating spreadsheets. The foundation for this is clean, well-organized data, which you can learn more about in our guide on data management in Excel. By handing these tasks over to bots, your team is free to focus on work that actually requires human insight.

The Brains Behind the Operation: AI and ML

While RPA is busy handling the repetitive "doing," Artificial Intelligence (AI) and Machine Learning (ML) are responsible for the "thinking." If RPA represents the hands of your automation setup, AI and ML are the brains. These advanced systems don't just follow a script; they learn and adapt.

By analyzing your historical financial data, AI and ML algorithms can spot patterns, flag anomalies, and uncover trends that would be nearly impossible for a person to find manually.

For example, an AI-powered platform can:

- Identify unusual transactions that don't match typical spending habits, giving you an early heads-up on potential fraud.

- Scan expense reports to automatically check for compliance with company policies, drastically cutting down on manual review.

- Draft narrative summaries for financial statements, turning raw numbers into clear, easy-to-understand insights for executives.

It's this powerful combination of RPA and AI that makes modern financial automation so effective. The bots manage the tedious, high-volume work, clearing the way for AI to deliver the deep analysis needed for smart, strategic decisions.

This dynamic duo is precisely why the RPA in finance market is booming. It jumped from $9.82 billion to $12.32 billion in a single year and is projected to skyrocket to over $30.17 billion by 2029. The demand for more intelligent and efficient financial operations is fueling this incredible growth.

Your Step-by-Step Implementation Guide

Bringing financial reporting automation into your company can feel like a huge project, but you can break it down into manageable steps with a smart approach. A successful rollout isn’t about flipping a switch and hoping for the best. It's a thoughtful process that begins with a hard look at where you are now and ends with a more empowered, strategic finance team.

Here's a practical roadmap to guide you through it.

Step 1: Assess Your Current Processes

Before you can dream of automating, you need a painfully honest picture of your current workflows. Get in the trenches and map out your entire financial reporting cycle, from the moment data comes in the door to when the final report lands on a stakeholder's desk.

You need to find the bottlenecks. Where is your team bleeding time? Is it the soul-crushing task of reconciling accounts, fixing endless data entry mistakes, or wrestling with spreadsheet formatting? Nailing down these pain points is critical because it tells you exactly where automation will give you the biggest and fastest win.

Step 2: Define Clear and Measurable Goals

Once you know what’s broken, you can set clear goals for fixing it. "We want to be more efficient" is a nice sentiment, but it’s not a goal. You need to get specific and set targets you can actually measure.

Think in terms of concrete outcomes. For instance, your goals could look like this:

- Slash the month-end closing process from five days down to just two.

- Reduce data entry errors by 95% within the next three months.

- Give each finance team member an extra 15 hours per month to focus on analysis, not admin.

Having these kinds of tangible targets will make it much easier to choose the right software and, just as importantly, prove the ROI to leadership later on.

Step 3: Choose the Right Automation Tools

Not all automation software is built the same. The tool you choose must directly support the goals you just set. Look for solutions that play nicely with the systems you already rely on, like your ERP and accounting software. A clunky, hard-to-use interface is a non-starter—your team simply won't use it.

For example, if your team practically lives in spreadsheets, an AI-powered add-in could be the perfect entry point. Tools like Elyx.AI slot right into these familiar environments, which dramatically lowers the learning curve. If you're curious about what's possible within your existing setup, our guide on how to analyze data in Excel with advanced techniques is a great read.

Step 4: Implement in Phases with a Pilot Project

Don't try to boil the ocean. Attempting to automate everything all at once is a classic mistake and a fast track to failure. A phased rollout is always the smarter move. Start small with a low-risk pilot project that tackles one of the major pain points you found back in Step 1—automating expense report reconciliation is often a great candidate.

A successful pilot project is your best friend. It acts as a proof-of-concept, showing skeptical colleagues that this stuff actually works. It also helps you iron out any wrinkles in a controlled way before you go big.

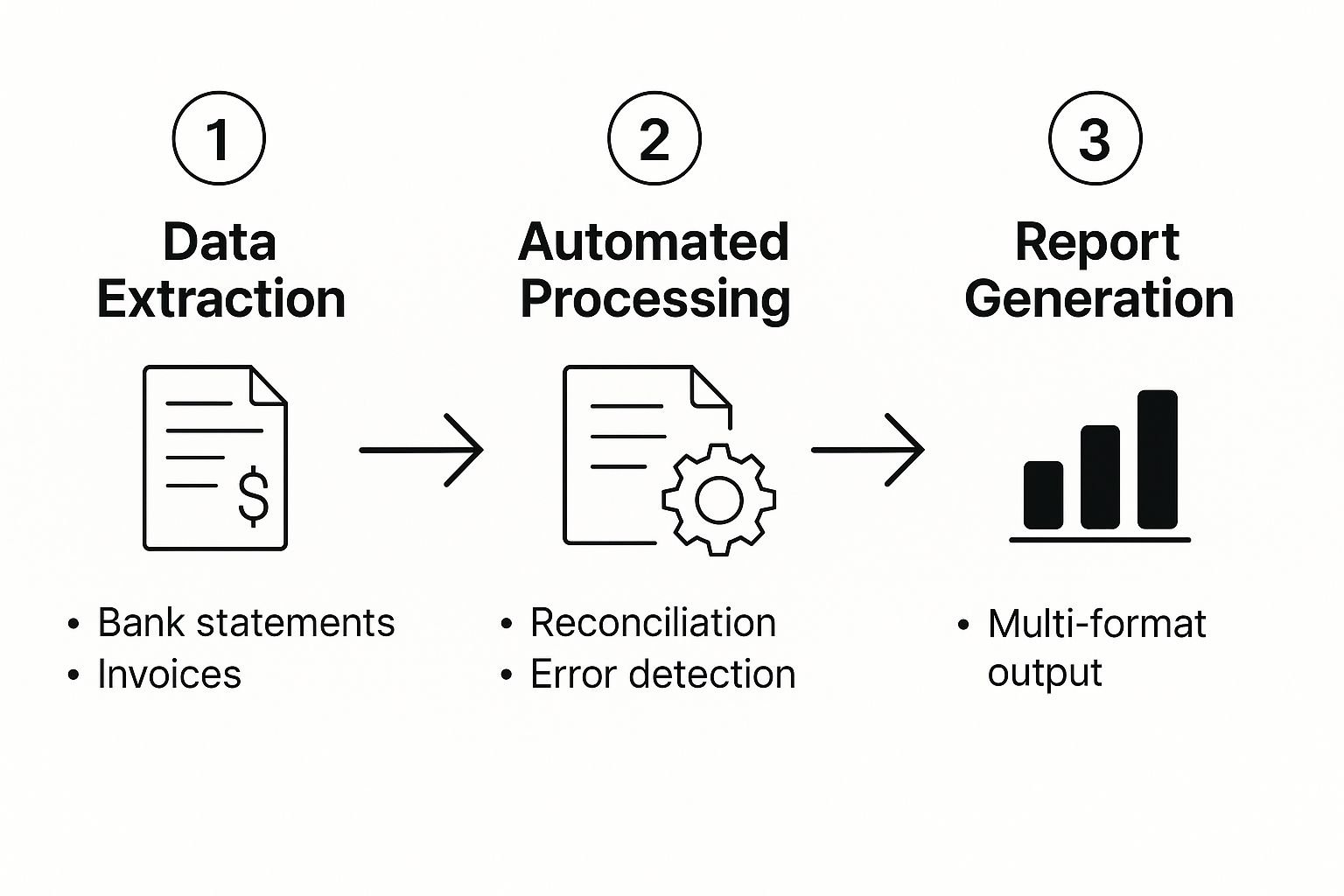

This visual shows what a typical automated workflow looks like in practice, from grabbing raw data to generating the final report.

As you can see, automation creates a smooth, hands-off flow that transforms messy inputs into polished reports ready for any audience.

Step 5: Train Your Team and Manage the Transition

Finally, never forget that the best tech is useless without the people who use it. Your team is the most important part of this equation. Be prepared for some resistance to change—it’s only natural.

Address it head-on by being transparent about the benefits. Frame automation as a tool that gets rid of the boring stuff so they can focus on more valuable work, not as something meant to replace them. Invest in solid training and be there to offer support. When you do that, you'll see skepticism turn into enthusiasm.

Financial Automation in the Real World

It’s one thing to talk about technology, but seeing financial reporting automation in action is where its true value really clicks. Let's move past the theory and look at how this actually changes the daily grind for finance professionals. The difference is night and day, especially in those core tasks that have always been manual, slow, and riddled with potential mistakes.

Think about the traditional Accounts Payable (AP) process for a minute. It’s a classic paper chase—opening mail, manually typing in invoice details, trying to match them to purchase orders, and then hunting down people for approvals. Every single step is an opportunity for something to go wrong. Automation flips the script entirely. Invoices come in and are captured automatically, data gets pulled using OCR, and the system instantly matches everything against purchase orders, flagging any exceptions. What you get is a payment cycle that's not only faster but far more accurate, with a perfect audit trail.

It's the same story on the flip side with Accounts Receivable (AR). Automation helps teams get cash in the door faster by handling things like creating and sending invoices and even sending out polite payment reminders on its own.

Accelerating the Month-End Close

Ah, the month-end close. It's a rite of passage for every finance team, usually involving long hours, cold pizza, and the stress of reconciling endless accounts. Automation completely rewrites this stressful narrative, turning a chaotic scramble into a smooth, predictable process.

Instead of someone having to manually pull data from a dozen different systems, an automated platform does the heavy lifting by consolidating everything in real time. Reconciliations that used to take days of painstaking work are suddenly finished in a few hours because the system can match thousands of transactions and spot discrepancies automatically. This frees up your team’s time, which is the whole point. Now they can focus on analyzing what the numbers actually mean. Of course, presenting those insights effectively is a skill in itself, something we cover in our guide to data visualization best practices.

By automating routine closing tasks, teams can shift their focus from verifying data to interpreting it, providing leadership with faster, more meaningful insights into business performance.

Simplifying Complex Regulatory Reporting

Staying compliant with regulations like Sarbanes-Oxley (SOX) or IFRS demands absolute precision and transparency. When you're doing this by hand, it’s a high-stakes, high-effort game. Automation builds a solid, reliable framework to manage these requirements, giving you more confidence with a lot less manual effort.

For instance, an automated system can:

- Generate compliant reports with pre-built templates that are already configured for specific regulatory standards.

- Maintain a detailed audit trail by logging every single touchpoint, from the initial data entry to the final approval, creating an airtight record.

- Enforce internal controls by standardizing how work gets done and locking down financial data from any unauthorized changes.

The momentum here is clear. The AP/AR automation market jumped from $2.4 billion to $2.61 billion in just one year and is on track to hit $3.95 billion by 2029. That kind of growth shows a massive demand for tools that make finances more accurate and operations more efficient. You can discover more about AP/AR market trends to see just how these solutions are changing the game. This move from manual to automated isn't just about saving a few hours; it's about building a smarter, more resilient finance department.

Of course. Here is the rewritten section, designed to sound like it was written by an experienced human expert.

Sidestepping the Pitfalls: Common Hurdles in Automation Projects

While the benefits of automating financial reporting are clear, the journey to get there can have its share of bumps. Let's be honest, no major software implementation is a perfectly straight line. Knowing what to watch out for is the best way to keep your project moving forward and avoid getting bogged down.

The biggest—and I mean the biggest—issue we see time and again is messy data. Automation tools are incredibly powerful, but they aren't magic. If you feed them inconsistent, error-riddled information from a dozen different sources, all you’ll do is automate the chaos. Think of it like a chef trying to make a gourmet meal with spoiled ingredients; the result won't be pretty. Before you even think about flipping the switch on automation, you have to get your data house in order. That means setting up solid data governance rules and standardizing your formats.

Then there's the classic headache of getting new software to talk to your old systems. Many companies are still running on reliable, but aging, legacy platforms. These older systems weren't built for the interconnected world we live in today, and they can be notoriously difficult to integrate with modern tools.

Tackling Integration and Team Buy-In

Getting your new automation platform to seamlessly connect with your core ERP or accounting software is non-negotiable. If they don't sync up properly, your team will be stuck with manual workarounds, which completely defeats the point. When you're shopping for a solution, make sure you prioritize tools that offer robust, pre-built connectors for the systems you already depend on.

It's easy to get lost in the technical details, but a lot of people forget the human side of the equation. If your team thinks automation is coming for their jobs, you'll face a wall of resistance that can kill the project before it even gets off the ground.

You have to manage this change carefully. The key is to position the new tool as a powerful assistant that takes the tedious, repetitive tasks off their plate—not as a replacement. Here’s how you can get your team on board:

- Explain the Why: Show them how automation will free them up to focus on the interesting stuff, like analysis and strategy, where their skills truly shine.

- Invest in Real Training: Don't just hand them a manual. Provide thorough, hands-on training that builds their confidence and lets them see firsthand how the tool makes their work easier.

- Highlight the Quick Wins: Start with a small pilot project. When it succeeds, celebrate it! Showing skeptics tangible proof of the tool's value is the fastest way to win them over.

By getting ahead of these data, system, and people challenges, you can map out a clear path to success and turn potential roadblocks into wins for your finance team.

Still Have Questions? Let's Clear a Few Things Up

It's completely normal to have a few questions when you're thinking about a change as significant as automating your financial reporting. Here are some of the most common ones we hear from leaders just like you, along with some straight-to-the-point answers.

"We're Not a Huge Company. Is Automation Even for Us?"

Absolutely. It used to be that only massive corporations had the budget and IT muscle for this kind of technology, but that’s completely changed. Modern tools are built to scale.

Thanks to cloud-based platforms and flexible pricing, powerful automation is no longer out of reach for small and mid-sized businesses. It’s a way to level the playing field, giving you the same efficiency and accuracy that the big players have.

"I'm Worried This Will Replace My Team."

This is probably the biggest concern we hear, but it comes from a misunderstanding of what automation actually does. Think of it as a powerful assistant for your finance team, not a replacement.

It handles the mind-numbing, repetitive work—the data entry, the reconciliations, the copy-pasting. This frees up your skilled professionals to do what they do best: think, strategize, and provide real financial guidance.

Your team stops being data mechanics and starts being data storytellers. They get to shift their focus from "what happened?" to "what should we do next?"

"How Can I Trust an Automated Platform With Our Sensitive Data?"

Security is non-negotiable, and any platform worth its salt makes it the top priority. The best providers build their systems on a foundation of rigorous security measures.

Look for these essentials:

- End-to-end encryption that protects your data whether it's being sent or just sitting on a server.

- Granular access controls so you can decide exactly who sees and touches what information.

- Compliance with major standards, like SOC 2 and GDPR, confirmed through regular, independent security audits.

"What Kind of Timeline Are We Really Looking At?"

This isn’t a years-long project. While the timeline depends on the complexity of your operations, you can see results much faster than you might think. We always recommend starting small.

Pick one major headache—maybe it’s your monthly expense reporting—and launch a focused pilot program. You can often get something like that up and running in just a few weeks. This proves the value quickly and builds momentum for tackling bigger processes over the next few months.

Ready to stop wrestling with spreadsheets and start empowering your team with insights they can act on? See how Elyx.AI can bring intelligent automation directly into the Excel environment you already know.

Reading Excel tutorials to save time?

What if an AI did the work for you?

Describe what you need, Elyx executes it in Excel.

Try 7 days free