Mastering Excel Financial Formulas From PMT to NPV

When you think about financial planning, from managing a household budget to analyzing a multi-million dollar investment, one tool consistently comes to mind: Microsoft Excel. Its financial formulas are the workhorses of modern finance, a set of powerful, built-in functions that handle everything from simple loan payments (PMT) to complex investment valuations (NPV). They are the fundamental building blocks for financial modeling, trusted by seasoned professionals and small business owners alike.

Why Excel Still Dominates Financial Analysis

In an age of hyper-specialized financial software, how has a seemingly simple spreadsheet program remained the undisputed king? It's all about its universal accessibility and brilliantly intuitive design. Excel acts as a common ground, a shared space where a startup founder in a garage and a Wall Street analyst can speak the same financial language.

Think of Excel as the ultimate financial modeling sandbox. Its grid is a blank canvas, giving you the power to build intricate models from scratch without needing to write a single line of code. This simplicity is its secret weapon, turning dense financial theory into practical, actionable numbers you can see and touch.

Spending too much time on Excel?

Elyx AI generates your formulas and automates your tasks in seconds.

Try for free →The Foundation of Financial Literacy

For decades, Excel has been the primary way we learn and apply financial concepts. It's the place where abstract ideas, like the time value of money, stop being just textbook definitions and become tangible through hands-on formulas. This widespread adoption has built a massive, self-reinforcing ecosystem of knowledge and best practices.

Here's why it remains the top choice:

- A Universal Language: Passing around an Excel file is standard operating procedure. Its format is understood across the globe, making collaboration between departments, companies, and clients seamless and free of compatibility headaches.

- Total Flexibility and Control: Unlike rigid, single-purpose software that boxes you in, Excel gives you complete control. You can structure your analysis exactly how you want, link disparate data sets, and customize models to perfectly fit unique business challenges.

- A Low Barrier to Entry: Most professionals already have Excel on their computers and know their way around the basics. This sidesteps the need for expensive software licenses and lengthy training for core financial work.

At its heart, Excel made financial analysis accessible to everyone. It took powerful computational tools out of the exclusive realm of programmers and quants and placed them directly into the hands of everyday business decision-makers.

A Global Standard Backed by Numbers

This isn't just a feeling; it's a global reality. Since its debut in 1985, Microsoft Excel has grown into the most dominant spreadsheet application on the planet, with an estimated user base of 750 million to 1.5 billion people. This incredible reach is driven by its user-friendly interface and the raw power of its built-in functions—especially the Excel financial formulas that make complex calculations look easy. Tools like PMT for loans and XNPV for investment returns are woven into the fabric of daily financial operations worldwide. You can explore more of these powerful Excel statistics and see their impact on global business.

This colossal user base guarantees that Excel skills are not just useful but highly transferable across virtually any industry. Before we dive into the specific formulas, it's important to grasp this context. The functions we're about to unpack aren't just abstract tools; they are the very gears that drive countless financial decisions every single day.

Valuing Investments with NPV and IRR

So, you're faced with a big decision for your business—maybe buying new equipment or launching a new product line. How do you actually figure out if it's a smart move financially? This is where two of Excel's most powerful financial formulas come into play: Net Present Value (NPV) and Internal Rate of Return (IRR). These tools help you see beyond the upfront cost to understand a project's true, long-term worth.

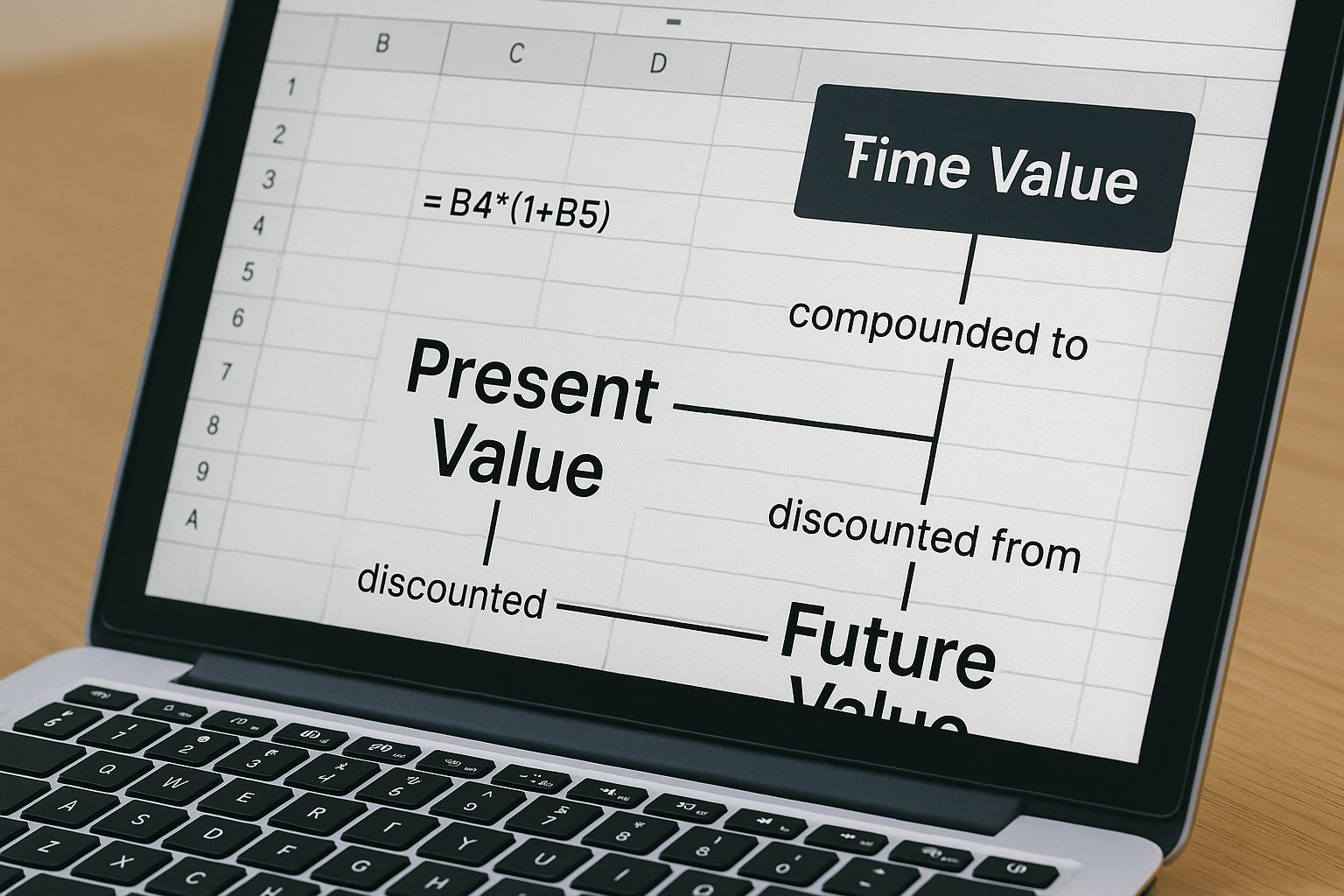

At the heart of both NPV and IRR is a simple but crucial concept: the time value of money. Think of it this way—a dollar in your hand today is worth more than a dollar you'll get a year from now. Why? Because you can invest that dollar today and earn interest on it. It’s a fundamental idea for making any sound financial forecast.

The following visual shows how this isn't just theory; it's a practical concept applied directly within a spreadsheet.

As you can see, financial formulas aren't abstract equations. They are working tools that use real data, with the time value of money as a key ingredient for an accurate analysis.

Understanding Net Present Value

Net Present Value (NPV) is all about translating future money into today's money. It takes all the cash you expect an investment to bring in over its lifetime and calculates what that entire stream is worth right now. Then, it simply subtracts the initial cost of the investment.

The final number tells you the total profit you'll make, all while accounting for the time value of money.

A positive NPV is a green light. It means the project is projected to be profitable and add value. A negative NPV is a warning sign, suggesting the investment will likely lose money and should be reconsidered.

The formula for NPV is surprisingly direct:

=NPV(rate, value1, [value2], ...)

- rate: This is your discount rate. Think of it as the annual return you could get from another, similar-risk investment.

- value1, value2, …: These are your cash flows, period by period. Use positive numbers for money coming in and negative for money going out.

One critical detail to remember: Excel's NPV formula is built to handle future cash flows only. The initial investment, which happens right now (at "time zero"), needs to be handled separately outside the formula.

Interpreting the Internal Rate of Return

While NPV gives you a hard dollar amount, the Internal Rate of Return (IRR) gives you a percentage. The IRR is the specific discount rate that would make the Net Present Value of all cash flows equal to exactly zero.

Put simply, it’s the investment's break-even point expressed as an annual return. If your project’s IRR is 15%, that means it's expected to generate a 15% return each year. You then compare that figure to your company's own required rate of return (often called a "hurdle rate") to decide if it's a go.

The IRR syntax is even cleaner:

- values: This is the full range of cash flows, starting with your initial investment (as a negative number).

- guess: An optional argument where you can input a starting guess for the IRR. You'll rarely, if ever, need to use this.

A Practical Example: NPV and IRR in Action

Let’s say a small business is thinking about buying a new delivery van for $40,000. They project it will generate additional cash flows of $12,000, $15,000, $14,000, and $13,000 over the next four years. The company's required rate of return for projects like this is 10%.

- Set up the data: In Excel, list the initial investment as -40000 in one cell, followed by the four annual cash flows in the cells below it.

- Calculate NPV: Assuming your cash flows are in cells B1 through B5, the formula would be

=NPV(10%, B2:B5) + B1. The result is $6,862. Since it's positive, the van looks like a good buy. - Calculate IRR: Using

=IRR(B1:B5), you’d get 18%. Since 18% is well above the company’s 10% hurdle rate, the investment gets a thumbs-up.

For situations where cash flows don't arrive in neat, yearly intervals, Excel provides XNPV and XIRR. These advanced versions let you specify the exact date for each cash flow, giving you even more precision. To explore these and other functions, check out these practical Excel formula examples that help bring these powerful concepts to life.

Calculating Loans and Investments with PMT, FV, and PV

While functions like NPV and IRR are great for big-picture business analysis, another set of financial formulas in Excel gets much more personal. The powerhouse trio of PMT, FV, and PV are the workhorses for anyone managing a loan, saving for a big goal, or figuring out how much to invest right now.

Think about it. When you're buying a house, the first thing on your mind is, "What's this going to cost me every month?" That's a question the PMT (Payment) function was born to answer.

Planning a Loan with the PMT Function

At its core, the PMT function calculates a steady, recurring payment for a loan based on a fixed interest rate. It strips away the complexity and gives you a single number to plan your budget around, whether for a mortgage, car loan, or student debt.

The syntax is pretty straightforward:

=PMT(rate, nper, pv, [fv], [type])

- rate: This is the interest rate for the loan. The key is to match it to your payment schedule. For a monthly mortgage, you must divide the annual rate by 12.

- nper: The total number of payments. For a 30-year mortgage with monthly payments, that's 30 * 12, or 360 payments.

- pv: The present value, which is just the total amount you're borrowing.

Let's walk through a real-world example. You're taking out a $300,000 mortgage at a 6% annual interest rate for 30 years. Your formula would be =PMT(6%/12, 30*12, 300000). Excel will return -$1,798.65, showing you the cash flowing out of your bank account each month.

Projecting Your Savings with Future Value (FV)

Now, let's flip the script from owing money to growing it. The Future Value (FV) function is your crystal ball for investments. It shows you what an investment could be worth down the road, based on consistent contributions and a steady interest rate. This makes it an amazing tool for retirement planning.

FV is essentially the mirror image of PV. Instead of telling you what a future chunk of cash is worth today, it reveals what your regular investments can blossom into over time, all thanks to the magic of compounding interest.

Imagine someone is starting to save for retirement. They decide to put away $500 every month into an investment account they hope will earn an average of 7% annually over the next 25 years.

To see what that nest egg could grow into, they’d use the FV function:

=FV(rate, nper, pmt, [pv], [type])

The formula in Excel would be =FV(7%/12, 25*12, -500). The result is an incredible $403,714.44, a powerful illustration of how small, disciplined investments can build serious wealth.

Figuring Out "How Much Now?" with Present Value (PV)

Finally, we have the Present Value (PV) function, which tackles a different but equally vital question: "If I want a certain amount of money later, how much do I need to invest today?" It’s the perfect formula for anyone with a specific financial target in mind.

The PV formula tells you the current value of a future lump sum or a series of payments. It helps you calculate the seed money you need to plant today to reach a financial goal, factoring in the growth it will achieve over time.

For instance, new parents want to have $50,000 ready for their child's college fund in 18 years. If they believe their investments can earn an average annual return of 8%, how much do they need to invest in one lump sum today?

Using the formula =PV(8%, 18, 0, 50000) gives them the answer: -$12,512.37. This means a single investment of just over $12,500 today could grow to that $50,000 target in 18 years without them adding another dime.

As you can see, this group of financial formulas provides a complete toolkit for personal finance—from managing your debts to building your future wealth.

Building Dynamic Financial Models

Once you've mastered the standalone functions like PMT or NPV, the real fun begins. You're ready to move past simple calculations and start building financial models that truly work for you. This is the leap from just crunching numbers to creating intelligent, adaptable systems that can handle real-world complexity.

A top-tier financial model isn't static. It should react automatically when new data flows in, adjust to different assumptions you want to test, and present everything clearly without you having to constantly babysit it. To get there, you need to combine Excel’s lookup, reference, and logical functions into powerful, custom-built tools.

Beyond VLOOKUP: The Power of INDEX MATCH

For a long time, VLOOKUP was the go-to function for grabbing data from a table. But anyone who has used it extensively knows its frustrating limits—it can only look from left to right, and it breaks the moment you add a new column to your data.

That’s why experienced analysts have largely moved on to a far more flexible and robust combination: INDEX and MATCH.

Think of it like finding a book in a library.

- MATCH is like using the card catalog to find the shelf number. You tell it what you're looking for (e.g., "Sales Revenue"), and it tells you which row it's on (e.g., row 5).

- INDEX is like going to that specific shelf. You give it the range of data (the "bookshelf") and the row number from MATCH, and it pulls out the exact value you need.

Together, they create a precise, two-way lookup that's faster and far more resilient than VLOOKUP. You can pull data from any direction—left, right, up, or down—and your formulas won't shatter if you decide to restructure your spreadsheet.

Creating Self-Updating Ranges with OFFSET

Financial models are living documents. You’re constantly adding new months of data, new product lines, or new expense categories. If you have to manually update every SUM or AVERAGE formula each time, you're not just wasting time—you're inviting errors.

The OFFSET function is the solution. It lets you create dynamic ranges that expand on their own.

OFFSET works by starting at a specific cell and then creating a range based on the height and width you define. By pairing it with a function like COUNTA (which counts all non-empty cells), you can build a range that automatically includes all your data, no matter how much you add.

For example, a formula like =SUM(OFFSET(A1, 0, 0, COUNTA(A:A), 1)) will always sum everything in column A. Add a new number at the bottom, and the formula instantly includes it. This is a game-changer for building scalable sales forecasts or cash flow statements that need to grow with your business.

By 2024, financial analysts worldwide rely heavily on a core set of formulas deemed essential for high-level tasks. These include INDEX MATCH for dynamic data lookups, IF combined with logical operators for conditional logic, and OFFSET paired with SUM for dynamic range calculations. Discover more insights about these essential advanced Excel formulas on corporatefinanceinstitute.com.

Weaving Logic with Nested IF, AND, and OR

Business decisions are rarely black and white. To reflect this, your models need to handle multiple conditions. This is where nesting IF statements and combining them with the AND and OR functions becomes absolutely essential.

These logical operators allow you to build sophisticated decision-making rules right into your cells.

- IF Statement: The foundation.

IF(this condition is true, do this, otherwise do that). - AND Function: Checks if all specified conditions are true. For example,

IF(AND(Sales>10000, Region="North"), "Eligible for Bonus", "Not Eligible"). - OR Function: Checks if at least one condition is true. For example,

IF(OR(ClientStatus="VIP", OrderValue>5000), "Priority Shipping", "Standard").

By layering these, you can map out complex business logic. Think about a model for calculating sales commissions with different tiers, special rates for new vs. existing clients, and extra bonuses for hitting stretch goals. Putting this together manually is intricate work, but it's what separates a basic spreadsheet from a powerful analytical tool. The good news is, you can always make the process better; many analysts find that exploring Excel reporting automation dramatically cuts down the manual effort these complex tasks require.

These advanced combinations are what transform your spreadsheet from a static calculator into a responsive, analytical powerhouse. They are the backbone of interactive dashboards, what-if scenario analyses, and robust financial forecasts that can tackle real-world business challenges with far greater precision and efficiency.

Generating Formulas Instantly with Elyx AI

Getting the hang of individual financial formulas is a great start. But the real headache often begins when you need to weave them together into a complex, nested expression. Anyone who’s tried to build a formula for something like a tiered commission plan or a dynamic loan schedule knows the pain. It's a slow, frustrating game of trial and error where one misplaced comma or bracket can torpedo your whole model with #VALUE! or #NUM! errors.

This is where a totally different approach changes everything. AI-powered tools like Elyx.AI are shifting how we work with spreadsheets. We're moving away from wrestling with syntax and back to focusing on what we actually want to accomplish financially.

As you can see, a simple request typed in plain English gets instantly translated into the exact, ready-to-use Excel formula you need. It completely removes the technical barrier, letting you describe the goal while the AI handles the construction.

From Manual Labor to Instant Results

Picture this: you need to build a complete amortization schedule for a client's new loan. Doing it by hand is tedious and requires you to know several interconnected formulas inside and out.

The Manual Way:

- Figure out the payment: First, you’d use the PMT function, carefully plugging in the rate, number of periods, and loan amount.

- Calculate the interest: For every single month, you'd then use the IPMT function, making sure to reference the right period and lock your cell references.

- Calculate the principal: Next up is the PPMT function, again, for each individual period.

- Track the balance: Finally, you'd set up a running total that subtracts the principal payment from the previous month's balance.

Trying to do this for a loan with hundreds of payments isn't just time-consuming—it's an error minefield. One small mistake in a single formula can mess up the entire schedule.

The AI-Powered Alternative with Elyx

Now, let's see how an AI-driven workflow compares. Instead of building the logic one painful piece at a time, you can give a single, clear instruction.

Simply type into Elyx.AI: "Create an amortization schedule for a $50,000 loan over 5 years at a 4.5% annual interest rate, showing the payment number, interest payment, principal payment, and remaining balance for each month."

Within seconds, Elyx.AI produces the entire table. All the necessary formulas—PMT, IPMT, PPMT—are perfectly structured and linked. The jump in productivity is huge and immediate. This isn't just about being faster; it's about being more accurate and making complex tasks accessible to everyone.

More Than Just a Formula Generator

These AI assistants do more than just spit out formulas; they also serve as interactive learning partners. When Elyx.AI gives you a complex formula, it also explains how and why it works. This is incredibly valuable for users at all levels.

- For Beginners: It demystifies tricky Excel financial formulas, breaking them down into simple parts and dramatically speeding up the learning process.

- For Experts: It’s like having a super-fast second opinion. It can confirm your logic and help you spot potential errors before they become problems, letting you build more advanced models with confidence.

By taking care of the complicated syntax, Elyx.AI frees you up to think about the bigger picture—interpreting the results, running different what-if scenarios, and making informed strategic decisions. This shift is a crucial step if you want to fully automate Excel and find a new level of efficiency. It turns Excel from a tool you have to painstakingly command into a smart partner that actually understands your intent.

Common Mistakes in Financial Formulas and How to Fix Them

Let's be honest, even a tiny mistake in an Excel formula can create a massive ripple effect. What starts as a confident forecast can quickly become a misleading analysis. Getting good at these functions isn't just about memorizing syntax; it's about learning to sidestep the common traps that even seasoned pros fall into now and then.

One of the most frequent slip-ups is using a mismatched time period. This is when you mix and match time units, like using an annual interest rate with monthly payments in a PMT formula, or an annual discount rate with quarterly cash flows in an NPV calculation. The interest rate and the payment period absolutely must be on the same page.

Think about it this way: you're calculating a monthly mortgage payment with a 6% annual interest rate, but you forget to adjust it. Excel's PMT formula will assume that 6% is a monthly rate, leading to a wildly inflated payment figure and a budget that's dead on arrival.

Fixing Mismatched Time Periods

The fix here is straightforward but critical for accuracy. You just need to break down your annual rates and scale up your periods to match how often payments or cash flows occur.

- For monthly calculations: Divide the annual rate by 12 and multiply the number of years by 12.

- For quarterly calculations: Divide the annual rate by 4 and multiply the years by 4.

- For semi-annual calculations: Divide the annual rate by 2 and multiply the years by 2.

Making this a habit ensures your models for loans, investments, and annuities are actually grounded in reality. Skip this step, and you're not just off by a little—you're working in a completely different financial universe.

Another classic pitfall is messing up the signs for cash flows. Excel’s financial functions operate on a simple but strict convention: money you get (inflows) is positive, and money you pay out (outflows) is negative. Getting this backward is like trying to balance your checkbook by adding your expenses instead of subtracting them. It just doesn't work.

Remember the golden rule of financial modeling in Excel: If cash is leaving your pocket, it’s a negative number. If it’s coming into your pocket, it’s a positive number. This applies to initial investments, loan payments, and project returns.

For instance, when you're calculating an IRR, that initial investment has to be a negative number. If you list it as positive alongside all the positive cash inflows it’s supposed to generate, Excel will throw a #NUM! error. Why? Because it’s mathematically impossible for an investment with no cost to have a rate of return.

Misinterpreting Your Results

Finally, one of the most dangerous mistakes has nothing to do with the formula itself, but with misinterpreting what the numbers are telling you. Getting a positive NPV or a high IRR feels good, but what do those figures actually mean for your project? An IRR of 15% might be amazing for a stable, low-risk business, but it could be a total deal-breaker for a high-risk startup.

The numbers never exist in a vacuum. You always have to weigh your results against your company's hurdle rate, industry benchmarks, and the specific risks involved. Using Excel financial formulas correctly is really a two-part skill: getting the calculation right, and then interpreting it wisely. Nailing both is how you make truly sound financial decisions.

Frequently Asked Questions About Excel Financial Formulas

Even after you’ve got a handle on the basics, some questions about Excel's financial formulas always seem to come up. Let’s tackle a few of the most common ones to help you clear up any confusion and get your analysis back on track.

What Is the Difference Between NPV and XNPV?

Think of it this way: NPV is like a metronome, ticking at a steady, predictable rhythm. It assumes your cash flows arrive at perfectly regular intervals—say, the first of every month or the end of every year. It works beautifully for straightforward, uniform investment timelines.

But real-world finances are rarely that neat. That's where XNPV comes in. It doesn't care about a steady rhythm; instead, it uses specific calendar dates for each cash flow. This makes it far more accurate for projects where money comes in and goes out on irregular dates, giving you a truer picture of your investment's value.

How Do I Handle Errors Like #NUM or #VALUE?

Seeing an error message in your cell is frustrating, but they’re actually helpful clues pointing you toward the problem.

-

#NUM!: This error usually means the math just doesn't work with the inputs you've given it. For example, if the IRR function can't find a rate of return that makes sense for your cash flows, it will return #NUM!. You might also see it if you've entered an illogical argument, like a negative number for the term of a loan.

-

#VALUE!: This is Excel’s way of telling you it got the wrong type of data. It was expecting a number but received text instead. The fix is usually as simple as checking your referenced cells to make sure they all contain numbers, not text or empty spaces.

Can I Combine Financial Formulas with Other Excel Functions?

Absolutely. In fact, this is where you can really elevate your spreadsheets from simple calculators to dynamic financial models. Nesting functions together lets you build in logic that automatically adapts as your data changes.

For instance, you could use an IF statement inside a PMT formula to calculate different loan payments depending on a borrower's credit score. Or, you could use SUMIF to add up only the positive cash flows before plugging that total into an NPV calculation. This ability to layer functions is what truly unlocks Excel's power for serious analysis.

Ready to stop wrestling with complex syntax and start getting instant, accurate answers? Elyx.AI integrates directly into your spreadsheet, generating the precise financial formulas you need from simple English prompts. Transform your data analysis and build better models faster.

Discover the power of AI-driven Excel assistance at https://getelyxai.com.

Reading Excel tutorials to save time?

What if an AI did the work for you?

Describe what you need, Elyx executes it in Excel.

Try 7 days free