How to Calculate Financial Ratios: A Simple Guide

I've always found that looking at a company's raw financial statements—the balance sheet, the income statement—is a bit like staring at a pile of puzzle pieces. You can see all the individual parts, but the big picture is missing. This is where financial ratio analysis comes in. It’s the process of connecting those pieces to reveal the true state of your business's liquidity, efficiency, and profitability.

Financial Ratios: More Than Just Numbers on a Page

Knowing how to calculate financial ratios is the key to turning those standalone figures into a clear story about your company's health. It’s a skill that isn't just for the accounting department; it's a fundamental diagnostic tool for any serious business owner, manager, or investor.

These ratios give you a standardized way to measure performance. They let you step back and see trends you might have missed, spot potential red flags before they become crises, and find opportunities hiding in plain sight. Essentially, they provide a common language for finance, making it possible to compare your performance against industry benchmarks or your closest competitors. Without them, you're navigating by gut feel alone, which is a risky way to run a business.

Spending too much time on Excel?

Elyx AI generates your formulas and automates your tasks in seconds.

Try for free →The Four Core Categories of Financial Ratios

When you start digging in, you'll find that most financial ratios fit neatly into one of four main categories. Each one offers a unique perspective on your company's operations. Getting a handle on these groups is the first real step toward building a complete financial dashboard for your business.

- Liquidity Ratios: These are all about your short-term staying power. They answer a simple but critical question: Can you pay your bills that are due right now?

- Leverage Ratios: This group tells you how much of your company's financing comes from debt versus equity. They’re a crucial gauge of your long-term financial stability and how much risk you've taken on.

- Efficiency Ratios: Sometimes called activity ratios, these measure how well you're using your assets. Are you turning inventory into cash quickly? Are your assets generating enough revenue? This is where you find out.

- Profitability Ratios: Just like the name implies, these ratios get straight to the bottom line. They measure how well your business generates profit from its sales, assets, and equity. Think of popular metrics like profit margin and return on investment.

Financial ratios aren't just calculations; they are the narrative of your business, translated into data. They turn intimidating financial reports into clear, actionable insights that empower you to make smarter decisions for long-term growth.

By mastering these metrics, you gain a massive advantage. You can get ahead of weaknesses before they escalate and confidently invest more resources into what's already working. In this guide, we'll get into the practical, step-by-step details of how to do just that.

Getting Your Hands Dirty with Liquidity and Leverage Ratios

Alright, you get the "why." Now it's time to roll up our sleeves and dig into the "how." The first stop on our journey into how to calculate financial ratios is liquidity—a measure of your company’s ability to cover its immediate bills. Think of it as your business’s short-term financial pulse.

We'll kick things off with the most common liquidity metric out there: the Current Ratio. This ratio gives you a broad overview of your ability to handle short-term debts with your short-term assets. The higher the number, the more of a cushion you have.

The Current Ratio Formula

To get this number, you just need to pull two figures from your company’s balance sheet. It’s pretty straightforward.

- Formula: Current Ratio = Current Assets / Current Liabilities

Let's imagine a retail business with $500,000 in current assets (this includes cash, inventory, and what customers owe you) and $250,000 in current liabilities (bills to suppliers, short-term loans, etc.).

The calculation is simply: $500,000 / $250,000 = 2.0. This means the company has $2.00 of current assets for every $1.00 it owes in the short term. While a 2.0 ratio is often seen as a healthy benchmark, don't take it as gospel. A service-based business with no inventory can do just fine with a lower ratio, whereas a capital-heavy manufacturer might need a much higher one. Context is everything.

A More Conservative View with the Quick Ratio

The Current Ratio is a great start, but it has one potential flaw: it includes inventory, which isn't always easy to turn into cash quickly. This is where the Quick Ratio (sometimes called the acid-test ratio) comes in handy. It offers a stricter, more conservative measure by simply pulling inventory out of the equation.

- Formula: Quick Ratio = (Current Assets – Inventory) / Current Liabilities

Sticking with our retail example, let's say that of the $500,000 in current assets, $150,000 is sitting on shelves as inventory. The Quick Ratio would be ($500,000 – $150,000) / $250,000, which equals 1.4. This is still a very solid number, showing the business can cover its debts without having a fire sale.

A Quick Ratio above 1.0 is generally considered healthy. It signals that your company has enough easily convertible assets to cover its immediate debts, providing a solid safety net if cash flow suddenly tightens.

Understanding Your Financial Leverage

Now, let's shift our focus from short-term health to long-term stability with a critical leverage metric: the Debt-to-Equity Ratio. This tells you how much of your business is financed by debt compared to the money invested by its owners.

- Formula: Debt-to-Equity Ratio = Total Liabilities / Total Shareholders’ Equity

For instance, if a company has $1,000,000 in total liabilities and $2,000,000 in shareholders' equity, the ratio is 0.5. This indicates that for every dollar of equity, the company has 50 cents of debt—a fairly conservative and healthy position.

To make things easier, here's a quick-reference table for these essential formulas.

Essential Liquidity and Leverage Ratio Formulas

| Ratio Name | Formula | Primary Data Source |

|---|---|---|

| Current Ratio | Current Assets / Current Liabilities | Balance Sheet |

| Quick Ratio | (Current Assets – Inventory) / Current Liabilities | Balance Sheet |

| Debt-to-Equity Ratio | Total Liabilities / Total Shareholders’ Equity | Balance Sheet |

Having these formulas handy can save you a lot of time as you analyze your financial statements.

Manually running these numbers can get repetitive, especially if you're tracking them month after month. To speed things up, you might find our guide on the top Excel financial formulas for business analysis useful for automating your workflow.

Gauging Your Operational and Profit Engine

Once you've confirmed your company is on solid ground financially, the real fun begins. Now we get to look at the engine of your business—how well it actually performs. This is where we dive into efficiency and profitability ratios. They tell a story about how effectively you’re turning your assets into revenue and, just as importantly, how much of that revenue becomes actual profit.

Think about it: an efficient company doesn't just own a bunch of stuff. It puts those assets to work. Inventory Turnover is a perfect example. It tells you how many times you’ve sold through your entire stock of inventory in a given period. A high number? That usually points to healthy sales and smart inventory management.

Unpacking Your Operational Efficiency

To get your Inventory Turnover, you’ll need two numbers: the Cost of Goods Sold (COGS) from your income statement and the average inventory value from your balance sheet.

- Formula: Inventory Turnover = Cost of Goods Sold / Average Inventory

Let’s say a business has a COGS of $600,000 and its average inventory is $100,000. The turnover ratio is 6.0. This means the company sold and restocked its entire inventory six times over the year. On the flip side, a low turnover can be a red flag, hinting at overstocking or sluggish sales that are tying up cash.

Another critical efficiency metric I always look at is Total Asset Turnover. This one gives you a broader view, measuring how well a company uses its entire asset base—everything from cash to machinery—to drive sales.

- Formula: Total Asset Turnover = Net Sales / Average Total Assets

If a company pulls in $2,000,000 in net sales with $800,000 in average total assets, its turnover is 2.5. This tells me it generates $2.50 in sales for every single dollar of assets on its books. That's a powerful insight.

How Profitable Is Your Company, Really?

Efficiency is great, but it's only half the story if it doesn't lead to profit. The Gross Profit Margin is a foundational ratio I always start with. It reveals how much profit you’re making from each sale after paying for the goods you sold.

- Formula: Gross Profit Margin = (Net Sales – COGS) / Net Sales

Picture a company with $2,000,000 in sales and a COGS of $1,200,000. The gross profit is $800,000, which makes the Gross Profit Margin 40% ($800,000 / $2,000,000). This means for every dollar in sales, 40 cents is left over to cover all other business expenses and, hopefully, turn into net profit.

For a much deeper dive into profitability, experienced analysts turn to Return on Equity (ROE). This is one of my go-to ratios because it's a powerful measure of how well a company is using shareholder investments to generate profit. A consistently high ROE is often the hallmark of a financially sound and well-managed company.

ROE directly links the bottom line (net income) to shareholder equity, giving you a clear picture of the return being generated for the company's owners.

- Formula: Return on Equity (ROE) = Net Income / Average Shareholders' Equity

So, if a business posts $300,000 in net income and has $1,500,000 in average shareholders' equity, its ROE is a healthy 20%.

A quick pro tip: notice the use of "average" for balance sheet items like assets or equity. To get a more accurate reading that isn't skewed by a single point in time, you simply add the beginning and ending balance of an account and divide by two. This smooths out any volatility and gives you a much better feel for the trend. For those who want to get into the weeds of these formulas, you can review this academic note on financial ratio formulas for a more detailed breakdown.

Bringing Your Ratio Analysis to Life in Excel with Elyx.AI

Let's be honest, manually plugging numbers into a calculator for ratio analysis is a drag. It’s not just slow; it’s a recipe for costly mistakes. We've all been there. Knowing the formulas is one thing, but calculating them efficiently and accurately, time and time again, is a completely different challenge. The smart move? Build a dynamic financial ratio dashboard right inside Excel.

Traditionally, you'd set up your financial data—assets, liabilities, income, etc.—in neat columns. Then comes the fun part: writing out long, complex formulas like =(B2-C2)/D2, carefully triple-checking every cell reference. It gets the job done, but the whole setup is incredibly brittle. One tiny slip-up in a cell reference can send your entire analysis off the rails.

A More Intuitive Way to Get Accurate Ratios

Thankfully, there's a much cleaner way to do this now. Instead of getting tangled up in cell addresses, you can let a tool like Elyx.AI handle the heavy lifting. It works by translating plain-English commands directly into the precise Excel formulas you need, which dramatically cuts down the risk of human error.

Picture your financial data laid out in a spreadsheet. Instead of racking your brain to remember the exact quick ratio formula and which cells contain current assets, inventory, and current liabilities, you could just type:

=elyx.ai("calculate the quick ratio using cells B2, B3, and B6")

Just like that, Elyx.AI understands your request and drops the correct, ready-to-go Excel formula into the cell for you. This doesn't just make the initial setup faster; it makes your spreadsheet infinitely easier for you (or a colleague) to audit and understand months down the road. It closes the gap between knowing what you want to find and knowing how to code it in Excel.

When you can turn your analytical questions into simple text prompts, you're no longer bogged down by formula syntax. Instead, your mind is free to focus on what really matters: financial strategy. This is how you move from basic data entry to true business insight.

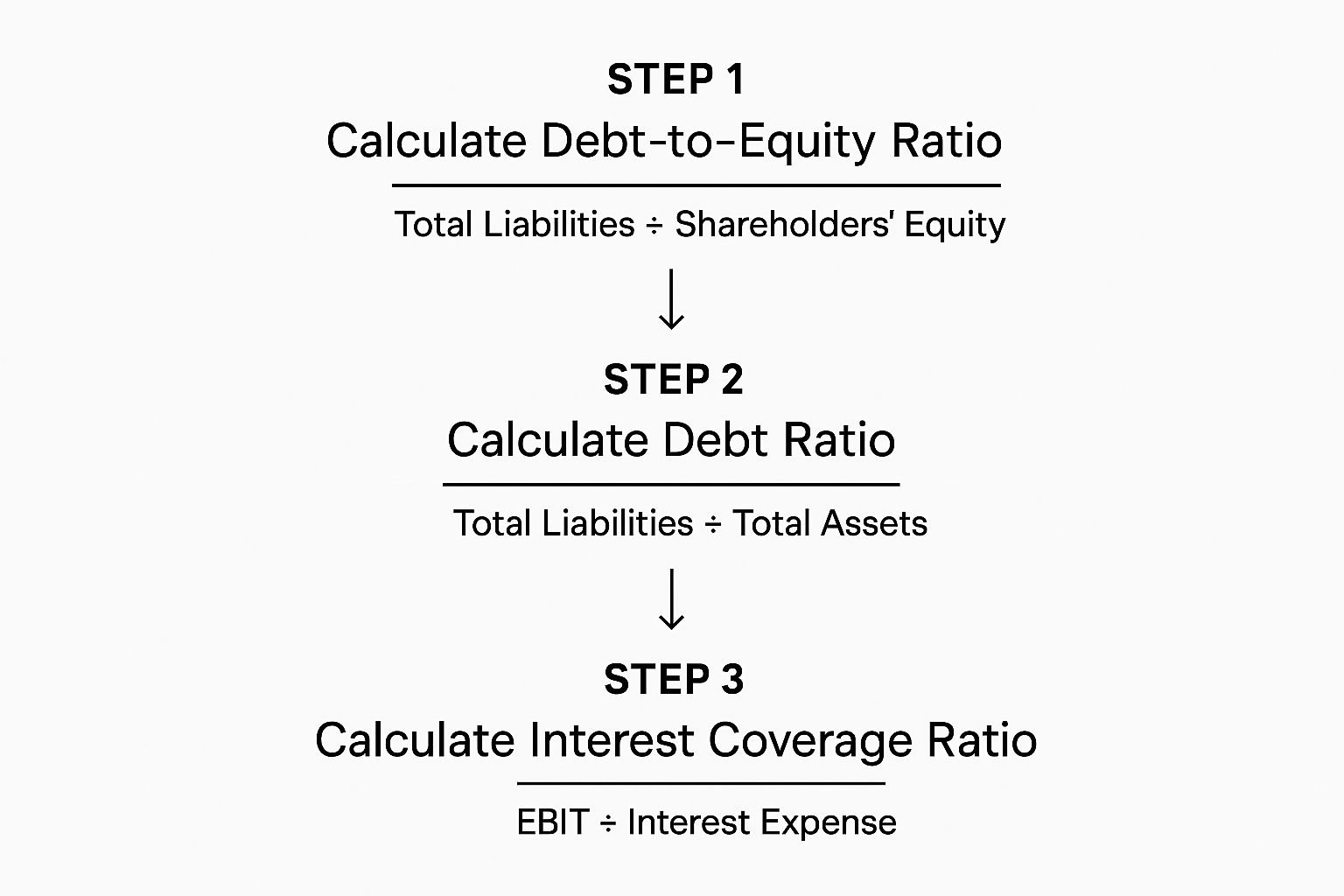

This visual breakdown shows how the numbers flow for key leverage and solvency ratios.

As you can see, the infographic clearly traces how different pieces of your balance sheet and income statement connect to reveal your company's debt load and its ability to cover interest payments.

Building a Smarter Analysis Tool

Automating your ratio calculations is a cornerstone of modern financial management. The ultimate goal is to create a dependable system that updates on its own as new financial data rolls in, giving you a live pulse on your company’s health without the manual grind.

Here’s a practical way I like to structure these automated dashboards:

- Dedicated Data Tab: First, create a single sheet that serves as the "source of truth." This is where you'll paste or import all your raw financial statement data. Keep it clean.

- Analysis Dashboard: On a separate sheet, build your analysis. This is where all the ratio calculations will live, keeping your workspace organized and focused.

- Plain-Language Formulas: Use Elyx.AI prompts to generate each ratio, pulling the necessary figures from your data tab.

- Bring it to Life with Visuals: Add a few charts that track your most important ratios over time. This turns a wall of numbers into a clear, visual story that’s easy to digest at a glance.

This structured setup makes your financial analysis repeatable, scalable, and far less prone to error. If you're looking for more ways to streamline your work, our guide on financial reporting automation has some great ideas to take your processes to the next level.

How to Interpret What the Numbers Are Telling You

Running the numbers and calculating financial ratios is just the first step. Honestly, it's the easy part. The real magic happens when you start to interpret what those figures are actually telling you. A single ratio, sitting all by itself, is pretty much meaningless. Its true value comes to life only when you give it context through comparison.

You’ll want to look at this from two key angles: trend analysis and industry benchmarking. Using both is non-negotiable if you want a complete, unbiased picture of your company's financial health.

Trend analysis is all about looking inward. You’re comparing your company's ratios over time—quarter over quarter, or year over year. This is how you spot momentum, good or bad. Is your debt-to-equity ratio slowly creeping up? Is your gross profit margin getting a little better each year? Spotting these patterns is far more insightful than just looking at one number from one period. If you need a refresher on wrangling historical data, we have a great guide on how to analyze data in Excel.

Industry benchmarking, on the other hand, forces you to look outward. How do your numbers stack up against your direct competitors or the industry average? This external context is crucial. Your inventory turnover might feel a bit sluggish, but if it’s actually better than the industry norm, you might be sitting on a competitive advantage without even realizing it.

Putting Interpretation into Practice

Let’s get practical with a real-world scenario. Say we’re looking at a small manufacturing company, "Precision Parts Inc.," and we've pulled its ratios for the last three years.

| Ratio | 2021 | 2022 | 2023 |

|---|---|---|---|

| Current Ratio | 2.2 | 1.8 | 1.3 |

| Gross Profit Margin | 45% | 46% | 47% |

| Debt-to-Equity Ratio | 0.6 | 0.9 | 1.5 |

So, what’s the story here? Let's break it down.

-

The Red Flag: That Current Ratio trend is an immediate attention-grabber. Dropping from a solid 2.2 to a much tighter 1.3 is a warning sign. It suggests a potential cash crunch is looming, as the company has far fewer liquid assets to cover its short-term debts than it did two years ago.

-

The Bright Spot: The Gross Profit Margin is steadily climbing. This is excellent news. It tells us Precision Parts is getting more efficient at making its products and is pocketing more profit on every dollar of sales.

-

The Underlying Cause: The Debt-to-Equity Ratio really connects the dots. It has shot up from 0.6 to 1.5 in just two years. This isn't a small jump; it signals that the company is taking on a lot of debt, and fast.

When you put these pieces together, a clear narrative emerges. Precision Parts is likely using debt to finance its growth, which is helping improve its operational profitability. However, this aggressive, high-leverage strategy is putting a serious strain on its short-term liquidity, creating a very real financial risk.

This is the core of financial ratio analysis. It's less about math and more about being a detective—finding the links between different metrics to uncover a company's strengths, weaknesses, and the strategic bets it's making. You're no longer just looking at numbers; you're diagnosing the health of the business.

Your Top Questions About Financial Ratios, Answered

Once you get past the textbook formulas, you'll find that using financial ratios in the real world brings up a lot of practical questions. It’s one thing to know the math, but it's another thing entirely to use it to make smart decisions. Let’s walk through some of the most common questions I hear from people just getting started.

Where Do I Actually Get the Data for These Formulas?

Great question. You don't need to go on a scavenger hunt; the information you need is already neatly organized in your company's core financial statements.

Most of the inputs for these ratios come from two key documents:

- The Balance Sheet: Think of this as a snapshot of your company's financial health on a specific day. It’s your go-to source for figures like Current Assets, Inventory, Total Liabilities, and Shareholders' Equity.

- The Income Statement: This report tells the story of your company's performance over a period, like a quarter or a full year. Here you’ll find crucial numbers like Net Sales, Cost of Goods Sold (COGS), and your bottom-line Net Income.

If you're looking at a public company, you'll find these statements in their quarterly (10-Q) and annual (10-K) reports filed with the SEC. For your own private business, this data lives inside your accounting software.

What’s a “Good” Number for a Ratio?

This is the million-dollar question, and the honest answer is always: it depends. There's no magic number that signals a "good" ratio across the board. Context is king. A healthy ratio for a cash-heavy retail business will look completely different from one for a high-growth tech startup that’s burning through capital.

So, how do you judge your numbers? It's all about comparison.

- Look at Your Own History: How do this quarter's ratios stack up against the last four quarters? A Current Ratio that’s been steadily dropping is a much bigger red flag than one that's just a bit lower than an arbitrary industry benchmark. This is called trend analysis, and it's incredibly powerful.

- Benchmark Against Your Industry: See how your numbers compare to your direct competitors or the industry average. This helps you gauge whether your performance is ahead of the pack, in line with it, or lagging behind.

How Often Should I Be Calculating These Ratios?

The ideal rhythm really depends on your company's situation. For a stable, established business, a quarterly review usually hits the sweet spot. It aligns with your financial reporting cycle and gives you a regular pulse on the business without getting bogged down in the data.

However, if your business is in a more dynamic phase—like a startup experiencing rapid growth, a company navigating a turnaround, or any business in a volatile market—you should be running the numbers monthly. When cash flow is tight or things are changing quickly, this frequency gives you the early warning you need to react. At a minimum, a deep-dive annual analysis is non-negotiable for strategic planning.

Relying on a single ratio is like trying to diagnose a patient by only taking their temperature—it's dangerously incomplete. True financial analysis requires a holistic view, looking at ratios from all key categories to get a balanced picture of a company's health.

Can I Really Just Use One Ratio to Judge a Company?

Absolutely not. Falling into this trap is one of the biggest mistakes you can make in financial analysis. Each ratio is just one piece of a much larger, more complex puzzle.

For example, a company might show a fantastic Profit Margin, which looks great in isolation. But what if its Debt-to-Equity ratio is through the roof and its Quick Ratio is alarmingly low? That high profit could be masking a serious liquidity crisis just waiting to happen. You only get a clear and reliable picture by looking at liquidity, leverage, efficiency, and profitability ratios together.

Ready to stop wrestling with manual calculations and focus on what the numbers mean? Elyx.AI integrates directly into Excel, letting you generate complex ratio formulas with simple, plain-English commands. Turn your spreadsheet into a powerful, automated analysis tool and get instant insights from your data. Explore how you can build a smarter financial dashboard.

Reading Excel tutorials to save time?

What if an AI did the work for you?

Describe what you need, Elyx executes it in Excel.

Try 7 days free