What is Data Reconciliation? Learn Its Importance Today

At its most basic, data reconciliation is the process of comparing two or more sets of data to make sure they match up perfectly. Think of it like a detective cross-referencing witness statements to get the real story. When the accounts differ, reconciliation is how you spot the inconsistencies, figure out why they happened, and correct them.

What Is Data Reconciliation in Simple Terms

Let's use a familiar example: balancing your checkbook. You have your personal record of every deposit and purchase, and then there's the official statement from your bank. Data reconciliation is that moment you sit down with both, comparing them line by line.

Spending too much time on Excel?

Elyx AI generates your formulas and automates your tasks in seconds.

Try for free →You're looking for discrepancies. Maybe you forgot to write down that morning coffee, or perhaps a check you deposited hasn't cleared yet. The goal is to spot every single one of these differences and make the necessary adjustments until your records and the bank's are in perfect agreement.

Why This Process Matters for Businesses

This same idea scales up massively in a business setting, but the core principle doesn't change. Companies are constantly juggling data from different systems that, in a perfect world, should tell the same story.

For example:

- The sales numbers from your CRM platform should align with the revenue reported in your accounting software.

- The inventory levels in your warehouse system need to match the units sold on your e-commerce site.

- The hours an employee logs in their timesheet should correspond with what the payroll system has on file.

When these datasets get out of sync, even by a little, it can cause a cascade of problems. You might end up with flawed business strategies, incorrect financial reports, or complete operational headaches. Proper data reconciliation stops these issues before they start, ensuring every decision is grounded in one reliable version of the truth. It's a cornerstone of solid data management in Excel and beyond.

To help break it down, here’s a quick summary of the key components involved in data reconciliation.

Data Reconciliation At a Glance

| Component | Description |

|---|---|

| Data Sources | The two or more datasets that are being compared (e.g., CRM vs. accounting software). |

| Matching Keys | The common identifiers used to link records across datasets (e.g., transaction ID, customer ID). |

| Discrepancies | Any differences found between the datasets, such as missing records or mismatched values. |

| Resolution | The process of investigating and correcting the discrepancies to achieve consistency. |

| Validation | The final step to confirm that both data sources are fully aligned and accurate. |

This table shows that reconciliation is a structured process, not just a random check. It’s a systematic way to enforce data quality.

Data reconciliation isn't just a back-office chore; it's a fundamental business practice that underpins trust in your numbers. Without it, you're essentially flying blind, making critical moves based on information that could be completely wrong. It's the ultimate quality control check for your company's most important asset—its data.

The Real-World Cost of Mismatched Data

While "data reconciliation" might sound like technical jargon, the fallout from skipping it is anything but abstract. When your datasets don't line up, the problem isn't just a messy spreadsheet—it's a direct hit to your operations, your bottom line, and your reputation. These aren't just hypotheticals; they're the everyday realities that prove this process is absolutely mission-critical.

Think about a retail business for a second. The inventory system says there are 100 units of a hot-selling product in stock, but the e-commerce platform has already processed 120 sales for it. That single discrepancy snowballs into overselling, canceled orders, and furious customers. The financial loss is immediate, but the damage to customer trust can linger for years.

Or consider a financial firm where the transaction logs from their trading platform don't match the records from the clearinghouse. This isn't just a rounding error; it’s a massive red flag for regulators. Discrepancies like this can trigger painful audits and steep fines for non-compliance, all stemming from a failure to reconcile two sources of truth.

The Ripple Effect of Inaccurate Data

The trouble with mismatched data is that it never stays contained. It creates a domino effect that can send shockwaves through an entire organization, proving why a holistic approach to data accuracy is so vital.

Here’s a quick look at how these issues cascade:

- Operational Chaos: When sales and inventory data are out of sync, it throws a wrench into everything from supply chain logistics to customer support. Your teams end up chasing down problems instead of driving the business forward.

- Financial Mismanagement: Bad financial data leads to flawed budgets, inaccurate P&L statements, and misguided strategic planning. You could be making major decisions based on information that's just plain wrong.

- Eroding Customer Trust: Nothing sours a customer relationship faster than a broken promise. Whether it's an unexpected order cancellation or an incorrect bill, these mistakes scream unreliability and send customers running to your competitors.

"Organizations investing in AI and automation must start with a strong foundation—clean, normalized, and reconciled data. Otherwise, they risk amplifying mistakes rather than solving problems." – Patty Azimi, Director of Client Strategy, Index Solutions

These real-world scenarios make it clear: data reconciliation isn't just an "IT thing." It's a fundamental business practice that prevents financial loss, sidesteps operational nightmares, and builds the trust you need to thrive. Without it, you're essentially flying blind.

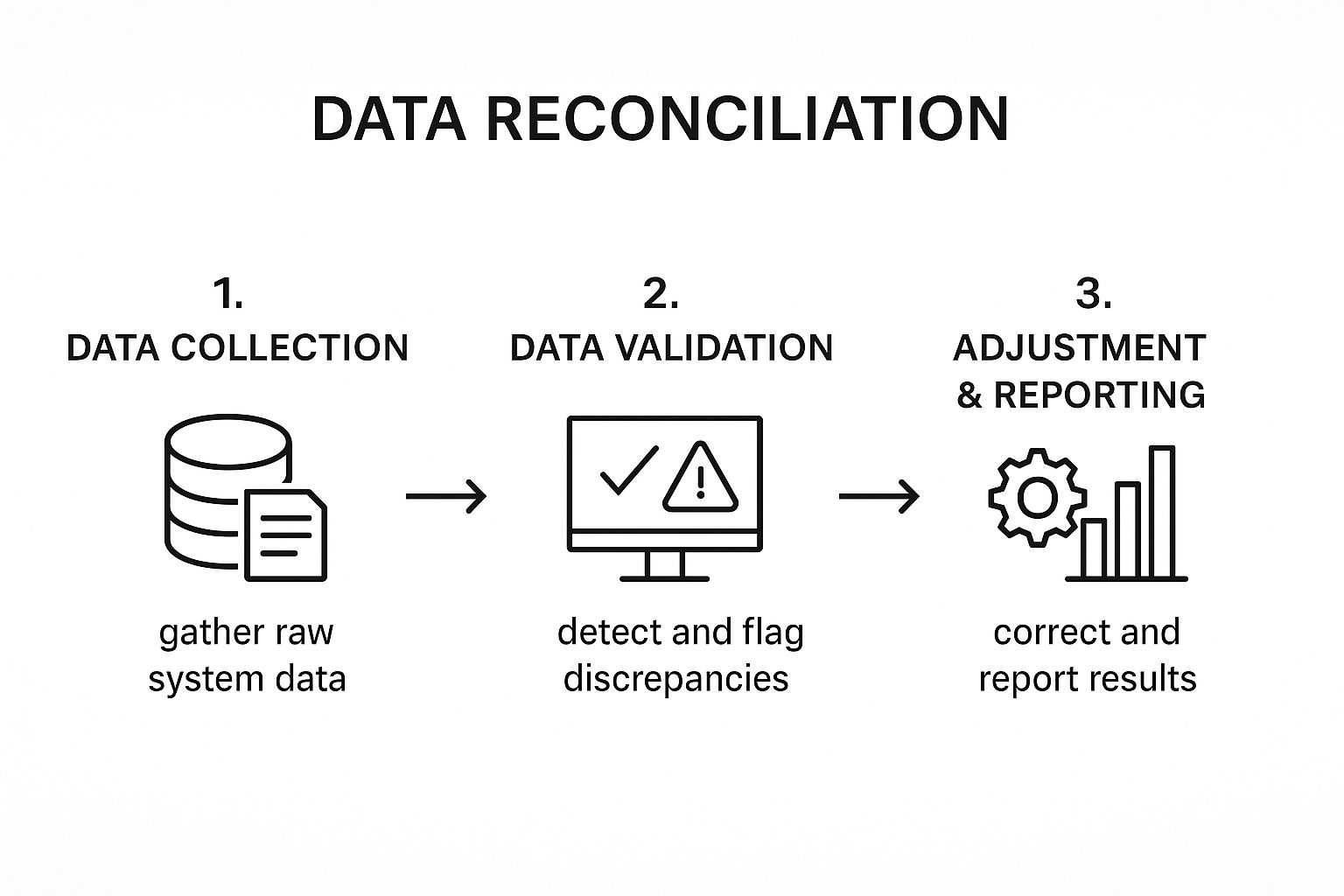

The Four Core Steps of Data Reconciliation

Knowing what data reconciliation is in theory is one thing, but seeing how it plays out in the real world is where the lightbulb really goes on. The whole process can feel a bit abstract, so let's break it down into four core steps. Think of it less as a one-and-done task and more as a continuous cycle that keeps your business information healthy and trustworthy over the long haul.

This flowchart maps out the journey, from gathering the raw data to validating it, making adjustments, and reporting on the outcome.

As you can see, this isn't a linear path with a final destination. It's a loop designed to maintain constant accuracy. Let's walk through each step together.

Step 1: Data Extraction and Collection

The journey always starts with gathering the datasets you need to compare. This means pulling information from two or more different systems. For instance, you might grab a sales report from your CRM and the matching transaction log from your payment gateway.

This first stage is all about getting your evidence together before you can start looking for clues. The goal is to make sure you have the complete and correct datasets for the specific period you're investigating.

Step 2: Data Comparison and Matching

Once you have your data, it's time to compare. Here, you line up the records from each source and try to match them using a shared piece of information, or a matching key. This could be a transaction ID, a customer email, or an order number—anything the two datasets have in common.

It’s a bit like laying out two nearly identical photos and playing a game of "spot the difference." You're looking for where everything lines up perfectly and, more importantly, where it doesn't. A common example is using a finance bank statement analyzer to check transactions between your company's books and the official bank records.

Step 3: Identifying and Investigating Discrepancies

This is where the real detective work begins. Any record that doesn't find a perfect match gets flagged as a discrepancy. These mismatches usually fall into a couple of categories:

- Missing Records: An entry shows up in one dataset but is completely absent from the other.

- Mismatched Values: The record exists in both places, but a key detail—like the total sale amount—is different.

Each of these flagged items needs to be investigated to uncover the root cause. Was it a simple typo during data entry? A system hiccup? Or maybe just a timing issue between when the two systems updated?

Finding the 'why' behind a discrepancy is often more valuable than just spotting the difference. It's what allows you to fix the root of the problem so it doesn't keep happening.

Step 4: Correction and Reporting

Finally, once you understand what caused the error, you fix it. This means correcting the inaccurate record right at the source, whether that involves updating a value, adding a missing transaction, or deleting a duplicate entry. For stubborn issues, knowing how to clean data in Excel can be a lifesaver.

After making the corrections, you'll usually create a reconciliation report. This report documents the changes you made and serves as official confirmation that the two datasets are now in complete agreement.

Exploring Common Data Reconciliation Techniques

So, you understand the steps. The natural next question is, "How do I actually do this?" The truth is, data reconciliation techniques run the gamut from straightforward manual checks in a spreadsheet to incredibly sophisticated, automated systems. The right tool for the job really depends on your data's complexity, sheer volume, and how fast you need to find discrepancies.

For smaller, more manageable tasks, a lot of teams still start with good old-fashioned manual methods right in their favorite spreadsheet program. Functions like VLOOKUP or INDEX-MATCH are the classic workhorses here, perfect for comparing two lists to see what lines up and, more importantly, what doesn't.

Think about a process like bank reconciliation — it's one of the most common examples out there. For many businesses, this starts with someone manually ticking off entries between the company’s cash book and the bank's statements. It works, but it has its limits.

The problem? These manual methods hit a wall as your data grows. Not only are they slow and tedious, but they're also a breeding ground for human error. They just can't keep up with the speed and scale that modern businesses demand. This is where the more powerful techniques enter the picture.

From Manual Checks to Automated Systems

As a business grows, so does its data. To keep everything in sync, organizations inevitably move toward more robust methods for maintaining data integrity across massive, complex datasets. These approaches are built for speed, accuracy, and reliability that no manual process can ever hope to match.

Here are a couple of the most common automated techniques:

-

Checksums and Hash Totals: This is a bit like creating a unique digital fingerprint for your data. You run a dataset through a hashing algorithm, and it spits out a unique code (the "fingerprint"). If you compare the hash totals from two different datasets and they match, you know the data is identical—without having to check every single row. If they don't, you've instantly spotted a problem.

-

Automated Reconciliation Software: This is the next level. Specialized tools are designed to connect directly to all your different systems—your CRM, ERP, accounting software, you name it. They automatically pull the data, compare everything based on rules you define, and flag every single mismatch for you to review.

Whether you're wrestling with a spreadsheet formula or deploying a dedicated software solution, the end goal is always the same: to create a single, reliable source of truth that everyone in the organization can trust.

Best Practices for an Effective Reconciliation Strategy

Let's be honest: a data reconciliation plan is only as good as the strategy behind it. Throwing tools at the problem won't work. To get results you can actually trust, you need a smart, sustainable approach.

It all starts with the quality of your source data. If your inputs are a mess, your reconciliation efforts will be a constant, uphill battle. Following solid data cleaning best practices isn't just a suggestion; it's the bedrock of a smooth process. You’ll save yourself a world of headaches by catching simple errors at the source.

Once your data is clean, you need to know who's in charge of it.

Establish Clear Ownership and Accountability

Every single dataset needs an owner. Think of them as the official go-to person for that data. When a mismatch pops up—and it will—this person is responsible for digging in and fixing it. This simple act of assigning ownership stops problems from being ignored and builds a culture where everyone cares about data quality.

At the same time, you have to be realistic. Chasing down every single cent is a waste of time. You need to decide what's "good enough" for your business.

This is where tolerance levels come in. You have to define what an acceptable variance looks like. For a financial report, a few cents might be completely fine. But for a warehouse managing high-value equipment, a one-unit difference is a major red flag. Setting these thresholds keeps your team focused on what truly matters.

Automate and Standardize Your Process

Trying to reconcile data by hand is a recipe for disaster. It’s painfully slow and practically guarantees human error. This is one area where automation is your best friend. It not only frees up your team's time but also enforces the same logic and rules every single time, leading to far more consistent results.

For instance, temporal reconciliation—the process of lining up data from different time zones or collection frequencies—can cut down on inconsistencies by as much as 40% when automated. When you're dealing with big data, automation isn't just a nice-to-have; it's a necessity.

Finally, to keep your strategy sharp and effective over the long haul, make these two habits non-negotiable:

- Schedule Regular Reconciliations: Don't wait for a crisis. Make reconciliation a routine part of your business cycle, whether that's daily, weekly, or monthly.

- Document Everything: Keep a detailed log of your reconciliation runs. Note what you checked, what you found, and how you fixed it. This creates an invaluable audit trail.

Putting these practices into place creates a strong framework that supports your organization's broader data quality best practices.

Got Questions About Data Reconciliation? Let's Clear Them Up.

As you start wrapping your head around data reconciliation, a few questions always seem to surface. It's totally normal. Getting these details straight is key to understanding how it all fits together in the real world.

Let's walk through some of the most common ones I hear.

What's the Difference Between Data Reconciliation and Data Validation?

This is a big one, and it's easy to see why people get them confused. They both deal with data quality, but they have very different jobs.

Think of data validation as a quality check on a factory assembly line. It inspects one item (or one piece of data) to make sure it meets the required specs. For example, it checks a phone number field to ensure it only contains numbers and is the correct length. It’s a check that happens inside a single dataset.

Data reconciliation, on the other hand, is like being an auditor comparing two different ledgers. It takes two sets of books that are supposed to tell the same story and checks if they actually match. For instance, does the number of units shipped from your warehouse system match the number of units billed in your finance system?

In a nutshell: Validation asks, "Is this data in the right format?" Reconciliation asks, "Does this data match across different systems?" You absolutely need both.

How Often Should My Team Reconcile Data?

There’s no magic number here. The right answer really boils down to two things: how fast your data changes and how much you rely on it.

- High-Volume, High-Stakes Data: Think financial trades, e-commerce orders, or inventory levels. For this kind of data, discrepancies can be costly, fast. You should be reconciling daily, if not multiple times a day.

- Slower-Moving Data: For things like monthly sales reports or comparing social media analytics across platforms, a weekly or monthly reconciliation usually makes sense. The data just doesn't change enough to warrant a daily check.

The best advice is to sync your reconciliation schedule with the natural rhythm of your business. Run it often enough to catch mistakes before they snowball into real headaches.

Can Data Reconciliation Be Fully Automated?

Yes, for the most part—and honestly, it should be. The tedious, soul-crushing work of manually matching records is exactly what computers are built for. A good tool can automatically pull data from your different sources, compare thousands of rows in seconds, and flag every single mismatch. This is a massive win, saving countless hours and slashing the risk of human error.

But "fully" is a strong word. Automation is brilliant at finding the what—the specific transaction that doesn't match. It often takes a human to figure out the why. Was it a data entry mistake? A system glitch? An unusual case that needs a judgment call? That’s where a skilled person steps in to investigate and make the final decision. The sweet spot is a blend of machine speed and human expertise.

Tired of manually comparing spreadsheets line by line? Elyx.AI brings powerful reconciliation and cleaning tools right into your Excel workflow. Ask questions in plain English, clean up messy data on the fly, and pinpoint discrepancies in seconds, not hours. See how much easier it can be by visiting Elyx.AI today.

Reading Excel tutorials to save time?

What if an AI did the work for you?

Describe what you need, Elyx executes it in Excel.

Try 7 days free