Automated Invoice Processing That Saves You Time

Automated invoice processing uses technology to take over the entire invoice journey, from the moment it lands in your inbox to the final payment. It gets rid of manual data entry and seriously speeds up the whole workflow. Think of it as a digital super-clerk—one that works around the clock to grab, read, and organize every invoice, turning a slow, mistake-prone chore into a well-oiled machine.

What Is Automated Invoice Processing

Picture your finance team drowning in a sea of paperwork. You've got physical stacks on desks, a flood of PDF attachments in their emails, and a never-ending cycle of follow-ups. For every single invoice, someone has to manually read it, punch the numbers into a spreadsheet or accounting software, and then start chasing approvals. It's not just slow; it’s a major bottleneck, and it’s ripe for human error. A single mistyped number can cause overpayments, damage vendor relationships, and create hours of frustrating cleanup work.

Spending too much time on Excel?

Elyx AI generates your formulas and automates your tasks in seconds.

Try for free →This is exactly the headache that automated invoice processing is designed to cure. Instead of people doing all the heavy lifting, specialized software steps in to manage the entire invoice lifecycle. It’s like having a smart assistant that handles the most mind-numbing parts of accounts payable. Best of all, it doesn't get tired, make typos, or misplace important documents.

Moving From Manual Labor to Smart Automation

Switching to automation is about more than just going paperless; it’s about fundamentally rethinking how your finance department works. Manual processing keeps your skilled people tied up with low-value data entry. Automation frees them to focus on work that actually moves the needle. For a deeper dive into the basics, this guide on general invoicing principles is a great resource.

With an automated system in place, the day-to-day looks completely different:

- No More Data Entry: Invoices are scanned automatically, and the key information is pulled out digitally.

- Instant Validation: The system can check an invoice against a purchase order or receipt in a matter of seconds.

- Smart Routing: Invoices get sent directly to the right person for approval based on rules you set, which means no more hold-ups.

By automating, companies can slash their invoice processing costs by up to 67% and boost their data capture accuracy to 99%. It’s not about replacing people—it’s about giving them the tools to do more strategic work, like financial analysis and vendor management.

At the end of the day, automated invoice processing takes a costly, high-risk manual task and turns it into an efficient and reliable part of your business. It elevates your accounts payable team from data entry clerks to true financial controllers who add real value to the company.

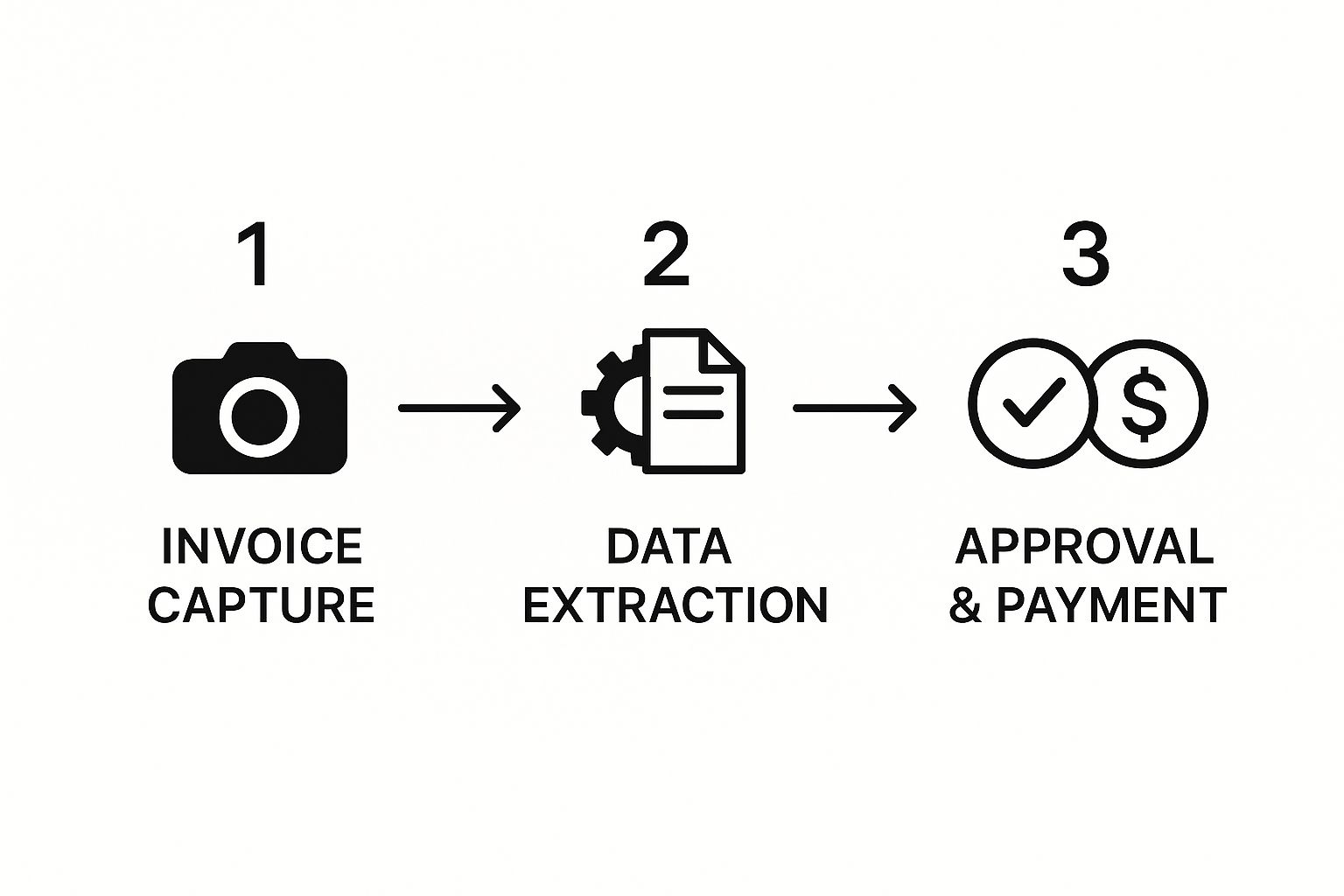

How Automated Invoice Processing Works Step by Step

To really get what automated invoice processing is all about, it helps to see how it works from start to finish. It’s not a single magic button. Think of it more like a smart, connected relay race where the invoice data is the baton, passed instantly from one stage to the next without ever being dropped. This completely gets rid of the manual checkpoints and long waits that bog down traditional accounts payable.

This simple breakdown shows the journey an invoice takes in a modern, automated system—from the moment it arrives to the final payment.

Each step flows into the next, building a financial pipeline that's fast, accurate, and completely transparent. Let’s walk through what’s happening at each stage.

Stage 1: Invoice Capture

The whole process kicks off the second an invoice lands in your system, and it doesn't matter how it gets there. It could be a PDF in an email, a scanned paper copy, or a file from a supplier portal. An automated system acts like a central inbox, grabbing every single invoice without anyone needing to lift a finger.

This first step is powered by Optical Character Recognition (OCR) technology. OCR is like a digital set of eyes for your computer; it scans the document and turns pictures of text into actual data the system can work with. So, instead of someone having to manually type in the vendor name or invoice number, the software reads and digitizes it on the spot.

Stage 2: Data Extraction and Validation

Once the invoice is captured, the real intelligence kicks in. This is where Artificial Intelligence (AI) and Machine Learning (ML) take center stage. The AI doesn’t just see words—it understands what they mean. It intelligently finds and pulls out all the critical data points, such as:

- Vendor name and contact info

- Invoice number and date

- Purchase order (PO) number

- Line-item details (quantity, description, price)

- Subtotals, taxes, and the final total

After pulling the data, the system runs an automatic validation check. This is often called three-way matching, where the software compares the invoice against the original purchase order and the goods receipt note. If everything lines up, the invoice is greenlit. If not, it gets flagged for a human to review, stopping bad payments before they ever happen.

This isn't just a niche trend; it's a massive shift. Recent data shows that about 75% of AP teams are already using some form of automation. Better yet, over 55% now rely on advanced OCR with machine learning to process invoices with almost no human touch. You can see more details in the automated invoice processing software trends from 360iResearch.

Stage 3: Automated Approval Routing

With the invoice data pulled and checked, it's time for approvals. In the old days, this meant forwarding emails or physically walking papers from desk to desk, a process famous for creating delays.

Automation fixes this with smart, rule-based workflows. The system automatically sends the invoice to the right person based on rules you set up—like the total amount, the department, or the specific vendor. For example, a marketing invoice under $1,000 might go straight to the marketing manager, while one over $10,000 might need a sign-off from both the department head and the CFO.

This automated routing means no more bottlenecks. Approvers get an instant notification and can review and approve invoices from anywhere, which massively speeds up the entire payment cycle.

Stage 4: ERP Integration and Payment

The last piece of the puzzle is connecting everything to your main financial systems. Once an invoice gets the final approval, all that verified data is automatically pushed into your Enterprise Resource Planning (ERP) or accounting software. This kills the last bit of manual data entry and guarantees your financial records are always spot-on.

From there, the invoice is scheduled for payment based on the agreed-upon terms. This end-to-end automation gives you a clear view of your entire accounts payable process. Tools like Elyx.AI's Excel add-in can take this even further, letting you analyze and report on this data right inside your spreadsheets. If you're interested in going deeper, you can learn more about how to automate Excel workflows here.

Manual vs Automated Invoice Processing: A Step-by-Step Comparison

To truly grasp the impact of this shift, let's look at the two approaches side-by-side. The table below breaks down the stark differences at each stage of the process, highlighting just how much efficiency is gained when you move away from manual methods.

| Process Stage | Manual Processing Approach | Automated Processing Approach |

|---|---|---|

| Invoice Arrival | Invoices arrive in various formats (mail, email) and are manually sorted and collected in a physical or digital pile. | System automatically captures invoices from all channels (email, scanner, portal) 24/7. |

| Data Entry | An AP clerk manually keys in data from the invoice into the accounting system. Prone to typos and errors. | OCR and AI technology automatically extracts and digitizes all relevant data with high accuracy. |

| Validation | A team member painstakingly cross-references the invoice with the PO and receipt notes by hand. | Software performs an instant three-way match, flagging any discrepancies for review in seconds. |

| Approval | The physical invoice or an email is manually routed to approvers, often getting lost or stuck in inboxes. | A rule-based workflow instantly routes the invoice to the correct approver based on predefined rules. |

| Payment & Archiving | Approved invoices are manually entered for payment. Paper copies are filed in cabinets, making them hard to find. | Approved data syncs directly with the ERP for payment. All documents are digitally archived and searchable. |

As you can see, the contrast is night and day. Automation doesn't just speed things up; it introduces a level of accuracy, visibility, and control that is simply impossible to achieve with a manual workflow.

The Real Payoff: What Invoice Automation Actually Does for Your Business

It’s one thing to understand the mechanics of automated invoice processing, but it’s another to see the massive impact it can have on a business. Let's get past the technical jargon. The real benefits aren't just small tweaks; they represent a complete shift in how a finance department works, turning a necessary cost center into a genuine strategic asset.

This isn’t just about getting a new piece of software. It’s a strategic decision to build a more efficient and reliable financial foundation for the entire company. The "why" behind automation is so powerful because it hits directly at the most common and frustrating pain points of old-school manual accounts payable.

Cut Your Processing Costs—Drastically

The first and most obvious win is a steep drop in what it costs to process an invoice. Manual invoicing is deceptively expensive once you add up all the hours people spend on data entry, checking for errors, chasing approvals, and filing paperwork. Every time a person has to touch an invoice, it adds to the cost.

Studies have shown that companies can slash their invoice processing costs by a staggering 67% by switching to automation. This isn't just about saving a few bucks on paper. It's about freeing up hundreds of hours your team would otherwise waste on tedious, repetitive work, allowing them to focus on high-value activities like financial analysis, budget forecasting, and negotiating better terms with vendors.

Think about it: if your team handles 1,000 invoices a month, what was once a week-long, error-filled nightmare can become a smooth, one-day task. Those savings in time and labor go straight to the bottom line.

This direct financial impact is why so many businesses are looking to get their AP functions in order.

Boost Accuracy and Reduce Financial Risk

Let's be honest—humans make mistakes. It’s an unavoidable part of any manual process. A single typo can lead to overpaying a vendor, paying the same bill twice, or missing a payment altogether. These little errors can strain supplier relationships and create huge financial headaches down the road.

Automated invoice processing practically eliminates these risks. By using smart technology like OCR and AI to pull and double-check data, these systems can reach an accuracy rate of up to 99%. That level of precision guarantees that the information on the invoice is exactly what ends up in your accounting software, every single time.

A huge benefit here is preventing expensive foul-ups. Automation creates a crystal-clear digital audit trail for every single transaction, making it simple to flag weird entries and avoid duplicate payments in accounts payable. This kind of built-in oversight acts as a powerful internal control, protecting your company's cash from preventable losses.

Speed Up Payments and Build Stronger Vendor Relationships

Nothing sours a relationship with a supplier faster than paying them late. Manual processing can easily take weeks, with invoices getting buried in inboxes or sitting on someone's desk waiting for a signature. These hold-ups often result in late fees and can seriously tarnish your company's reputation.

Automation shrinks the invoice-to-pay cycle from weeks to days, sometimes even hours. Once an invoice is captured, it’s automatically validated and routed for approval, moving through the entire workflow without friction. Research from the American Productivity & Quality Center (APQC) shows that manual processing takes an average of 8.3 days, while automation cuts that down to just 4 days.

This newfound speed gives you a few key advantages:

- Better Vendor Relationships: When you pay suppliers on time, every time, you build trust. That goodwill can lead to better pricing, more flexible terms, and stronger partnerships.

- Capture Early Payment Discounts: Processing invoices faster means you can finally take advantage of those early payment discounts that vendors offer, creating another simple way to save money.

- Clearer Cash Flow Visibility: With real-time data on exactly what you owe and when, you get a much sharper picture of your company's financial health, which is critical for smart cash management. To learn more about this, see our guide on financial reporting automation.

When you add it all up, these benefits create a more agile, accurate, and cost-effective accounts payable department, setting your business up for smarter financial management across the board.

What’s Under the Hood? The Tech Behind Invoice Automation

Automated invoice processing isn't just one magic button. It’s actually a combination of a few powerful technologies working together behind the scenes. Think of it like a highly skilled digital team, where each member has a specific job—reading, thinking, and communicating—to turn a slow, manual process into a fast and accurate one.

Let's break down the core components that make this all possible.

Optical Character Recognition: The Digital Eyes

The journey begins with Optical Character Recognition (OCR). This is the foundational technology that essentially gives the system its eyes. OCR scans any invoice document, whether it’s a PDF, a paper scan, or even a smartphone photo, and converts the text it sees into actual data a computer can work with.

Instead of someone having to squint at a screen and manually type in the vendor name, invoice number, and line items, OCR does the heavy lifting. It identifies the text and extracts it automatically, creating a digital version of the information that’s ready for the next step.

Artificial Intelligence and Machine Learning: The Brains of the Operation

If OCR provides the eyes, then Artificial Intelligence (AI) and Machine Learning (ML) act as the brain. Once the text is pulled from the invoice, AI steps in to actually understand it. This is where the real smarts come in.

It's not enough to just read the words; the system needs to know what they mean. For example, an AI model can:

- Classify Documents: It instantly knows it’s looking at an invoice and not a purchase order or a delivery slip.

- Understand Context: The AI figures out that "Due Date" is a date field and "Total Amount" is the final number to be paid, no matter where they’re located on the page.

- Flag Anomalies: Over time, ML algorithms learn what your typical invoices look like. If something seems off—like a duplicate invoice number or a total that's way higher than usual—it flags it for a human to double-check.

This intelligent layer is what makes modern automation so powerful. It's not a rigid, rule-based system. It learns and adapts, getting smarter and more accurate with every invoice it processes.

Seamless Software Integrations: The Central Nervous System

Finally, what holds this whole system together are seamless integrations. These connections are the central nervous system, letting data flow freely between all your different business tools. To be truly useful, an invoice automation platform can't live on an island; it needs to talk to your other software.

This creates a single, connected financial workflow. When an invoice gets approved, for instance, the integration can automatically send that data straight to your accounting software or ERP system. No more manual data entry. Exploring how tools connect, like using a connector to create a Jobber Zapier Invoice Sync, shows just how much a connected workflow can simplify things.

The demand for this kind of connected efficiency is exploding. The global market for this software was valued at around $36.1 billion and is expected to surge to $189.2 billion by 2035. This incredible growth, detailed in market analysis from Future Market Insights, shows just how essential these technologies have become for any modern finance team.

How to Implement an Automated Invoice System

Bringing in new technology can feel like a huge undertaking, but it doesn't have to be a headache. With a clear, structured plan, implementing an automated invoice system can be a smooth and successful transition. This isn't just about installing software; it's about thoughtfully redesigning a core business process to work smarter.

A methodical approach is your best friend here. It helps you minimize disruption, get your team on board, and see the benefits right from the start. Let's break down how to do it in a few manageable stages.

Analyze Your Current Workflow

Before you can build something better, you have to know exactly what you’re working with now. Start by mapping out your entire invoice process, from the second an invoice lands on someone’s desk (or inbox) to the moment payment goes out the door.

Your goal is to find every manual step, every bottleneck, and every frustrating delay. Ask some tough questions to get to the root of the problem:

- Where do things get stuck? Is it the initial data entry that slows everything down, or are invoices languishing while waiting for approvals?

- What are the most common mistakes? Are you constantly dealing with typos, duplicate payments, or invoices coded to the wrong department?

- How much time is each step really taking? Putting a number on it helps build a powerful case for making a change.

This initial analysis becomes your roadmap. It tells you exactly what problems your new system needs to solve.

Select the Right Automation Solution

With a clear picture of your needs, you can start looking at the tools out there. It’s important to remember that not all automation software is created equal. You’re looking for a solution that fits your company’s size, budget, and the software you already use.

Keep these key factors in mind during your search:

- Integration Capabilities: This is a big one. The software must play nice with your existing accounting or ERP system. If it doesn't, you're just creating another data silo, which defeats the whole purpose.

- Scalability: Think about the future. Will this system be able to handle double or even triple your current invoice volume without slowing down? You need a tool that can grow with you.

- Ease of Use: If the software is clunky and confusing, your team won't want to use it. A clean, intuitive interface is absolutely critical for getting everyone on board quickly.

For companies that live and breathe spreadsheets, a tool like the Elyx.AI Excel add-in can be a game-changer. It plugs AI-powered analysis right into the familiar Excel environment, making it easier to manage and report on financial data. Our guide on Excel reporting automation digs deeper into how you can make this happen.

Plan a Phased Rollout

It can be tempting to just flip the switch and move everyone over at once, but that "big bang" approach is risky. If you hit an unexpected snag, it can cause chaos for the whole company. A much safer bet is a phased rollout.

Start small. Run a pilot program with a single department or a small, dedicated group of users. This lets you test everything in a real-world setting, iron out any kinks, and get honest feedback before launching company-wide.

This approach also helps build momentum. Your pilot group becomes a team of internal experts who can help train and support their colleagues when it's time for the full rollout.

Train Your Team and Manage Change

At the end of the day, a tool is only as good as the people using it. Solid training isn't just a nice-to-have; it's essential. Your training shouldn't just cover the "how-to" of the new software, but also the why behind the change.

Show your team what's in it for them—less mind-numbing data entry, fewer mistakes to chase down, and more time for work that actually matters. Be ready to answer questions and address their concerns. Effective change management is all about great communication, making sure your team sees this new system as a tool that helps them succeed.

Measuring the ROI of Your Automation Investment

So, you're considering a switch to automated invoice processing. It’s a big move, and rightly so, you'll need to prove it’s worth the investment to get everyone on board. How do you show that this is more than just a fancy new tool? The answer lies in measuring your Return on Investment (ROI).

This isn't just about number-crunching for the finance department. It's about telling a compelling story of how automation makes the business healthier, faster, and more profitable. To do that, you need to track the right Key Performance Indicators (KPIs). Think of these as your "before and after" photos for your accounts payable process—they show exactly what’s improved.

Key Metrics for Tracking Automation Success

The strongest case for any new system is built on solid data. Before you flip the switch, you need to benchmark your current performance. Once you're up and running, tracking these same metrics will show you exactly where the value is coming from.

- Cost-Per-Invoice: This is your bread and butter. Tally up your AP department's total costs—salaries, overhead, the works—and divide that by the number of invoices you process. Automation slashes the manual effort needed for each invoice, so you should see this number drop dramatically.

- Invoice Cycle Time: How long does it take for an invoice to get from your inbox to paid? Manual processes can drag this out for weeks, creating bottlenecks and frustrating suppliers. With automation, you can shrink that cycle down to just a few days, which opens up some serious financial advantages.

- Error Rate Reduction: Let’s be honest, manual data entry is a recipe for typos, duplicate payments, and coding mistakes. Track the percentage of invoices that need a second look or correction. Automation can get this rate incredibly close to zero, saving you from costly rework and overpayments.

- Early Payment Discounts Captured: This is literally free money that most companies leave on the table. Faster processing means you can consistently pay within the discount window (think 1-2% off). Tracking the percentage of discounts you snag is a direct measure of your new financial agility.

Calculating Your Return on Investment

Once you have these KPIs in hand, calculating your ROI is pretty straightforward. While you can get complex with it, the basic formula is simple and effective:

ROI (%) = [(Financial Gain from Investment – Cost of Investment) / Cost of Investment] x 100

"Financial Gain" isn't just one thing. It includes direct savings (like lower labor costs) and new money you've brought in (like those early payment discounts). For instance, if you saved $50,000 in processing costs and captured $10,000 in new discounts with a system that cost you $20,000, your ROI is a whopping 200%. That’s a number that gets attention.

Beyond the Numbers: The "Hidden" Benefits

Hard data is king, but don't forget about the less tangible wins. These qualitative improvements have a real, if sometimes indirect, impact on your bottom line.

Just think about:

- Happier Employees: When you pull your team out of the data-entry trenches, they can focus on more strategic work that actually requires their expertise. This isn't just good for morale; it reduces burnout and turnover.

- Stronger Supplier Relationships: Paying your vendors on time, every time, builds a ton of goodwill. This can lead to better payment terms, preferential treatment, and a much more reliable supply chain when things get tight.

- Clearer Financial Visibility: Real-time data gives you an up-to-the-minute picture of your liabilities and cash flow. This means you can stop guessing and start making truly informed financial decisions.

The explosive growth in this space tells you everything you need to know. The market for invoice processing software is expected to climb from USD 33.59 billion in 2024 to USD 87.95 billion by 2029. You can discover more insights about this market expansion from ResearchAndMarkets.com. This isn't just hype; it's a reflection of the real, measurable ROI that companies are achieving every day.

Frequently Asked Questions

Diving into automated invoice processing often brings up a few common questions. It's natural to wonder about security, how new tools fit with your existing software, and what it really takes to get started. Let's tackle some of the most frequent queries we hear.

How Secure Is My Financial Data with Automation?

This is usually the first question people ask, and for good reason. Any trustworthy automation platform is built with serious security in mind. Your data is encrypted from the moment it's scanned until it's archived—what's called "in transit and at rest." Think of it like a digital armored car protecting your information at every step.

These systems also rely on secure cloud platforms and have strict rules about who can see or do what. This creates a detailed digital audit trail, which is far more secure than paper invoices that can be lost, misplaced, or physically stolen.

Will Automated Invoice Processing Integrate with My Current Accounting Software?

Absolutely. In fact, if it doesn't, you should walk away. Any worthwhile automation tool is designed to play nicely with major accounting and ERP systems like QuickBooks, SAP, Oracle NetSuite, and others.

This connection is what makes the whole process work so smoothly. Instead of manually downloading a report from one system and uploading it to another, the two programs talk directly to each other. Once an invoice gets the green light, all the data posts right into your general ledger, eliminating those pesky (and costly) manual data entry mistakes.

The goal is to make the technology fit your existing process, not the other way around. A system that doesn't integrate seamlessly will only create more work and new data silos.

How Long Does It Take to Get Started?

Getting up and running is probably faster than you imagine. A smart rollout starts with a small pilot program, which can have a single team or department onboarded in just a few weeks. A full, company-wide launch might take a couple of months, depending on how many custom approval workflows you have.

The secret is to take it one step at a time. Starting small lets you iron out any wrinkles and helps your team get comfortable before you scale it across the entire organization. Modern tools are built to be user-friendly, so your team can start feeling the benefits of automated invoice processing almost immediately.

Ready to bring AI-powered simplicity to your spreadsheets? With Elyx.AI, you can analyze data, translate text, and clean up your worksheets using simple, natural language commands. Transform how you work with your data by installing our powerful Excel add-in today. Learn more and get started at getelyxai.com.

Reading Excel tutorials to save time?

What if an AI did the work for you?

Describe what you need, Elyx executes it in Excel.

Try 7 days free