Your Guide to a Cash Flow Analysis Template

A cash flow analysis template is so much more than a spreadsheet. Think of it as a dynamic financial tool that tells the real, unvarnished story of your business's health. While a profit and loss statement is useful, this template maps the actual movement of cash into and out of your company, helping you spot potential cash shortages long before they become emergencies.

Why a Cash Flow Template Is Your Financial Co-Pilot

It's a painfully common scenario I’ve seen countless times: sales are booming, revenue charts are pointing up, but there's somehow never enough money in the bank to pay the bills. This exact paradox is where a cash flow analysis template shows its true value. It’s your financial co-pilot, guiding you past surface-level profits to give you a clear, honest picture of your operational liquidity.

Spending too much time on Excel?

Elyx AI generates your formulas and automates your tasks in seconds.

Try for free →Picture a growing retail business. On paper, they just closed a record-breaking quarter. The reality? To secure those big orders, they offered generous payment terms, and now their cash is all tied up in accounts receivable. Meanwhile, suppliers need to be paid upfront for the next batch of inventory. This is the classic "profit-rich, cash-poor" trap, and it can sink an otherwise successful company.

A well-built template helps you diagnose these hidden problems immediately. It turns abstract financial data into a tangible, actionable roadmap for your business's future.

Deconstructing the Template

An effective cash flow analysis template isn't just a jumble of numbers; it's a structured system built on a few core pillars. Each one tells a different part of your financial story, and when you put them all together, you get the complete picture.

To give you a clearer idea, here’s a breakdown of the essential elements that every good template needs. These components are the building blocks of a robust financial overview.

Core Components of an Effective Cash Flow Template

| Component | Purpose | Example Data Point |

|---|---|---|

| Cash Inflows | Tracks all sources of money entering the business. | $15,000 from collected client invoices |

| Cash Outflows | Details every dollar leaving the business. | $5,000 for monthly rent and utilities |

| Net Cash Flow | Calculates the simple difference: Inflows minus Outflows. | +$2,500 positive cash flow for the month |

| Opening/Closing Balance | Shows the cash on hand at the start and end of a period. | Opening: $10,000, Closing: $12,500 |

By keeping these components up-to-date, you can build a reliable snapshot of your financial position at any given time.

At its heart, the template works by tracking three main categories:

- Cash Inflows: This is where you log all the cash coming into your business. Think direct sales, payments on invoices (your accounts receivable), loan money you’ve received, or cash from selling an old asset.

- Cash Outflows: Here, you detail every single dollar going out. This covers everything from fixed costs like rent and salaries to variable expenses like raw materials, marketing campaigns, and supplier payments.

- Net Cash Flow: This is the bottom line, the simple but powerful result of Inflows minus Outflows. A positive number is great—more cash came in than went out. A negative number is a red flag, signaling a potential shortfall you need to address.

By diligently tracking these components, you can make confident, data-driven decisions on everything from hiring new staff and managing inventory levels to funding strategic growth initiatives. It stops you from flying blind and puts you in control.

The foundation of any reliable template is solid historical data. I always advise starting with at least 12 months of detailed financial records. This historical lookback is critical for understanding your business's cycles, which in turn allows for much more accurate forecasting. This principle holds true across every industry and is a cornerstone of sound financial planning. If you're interested in digging deeper, you can learn more about this critical step in cashflow planning to see how it directly impacts risk management.

How to Build Your Cash Flow Template in Excel

Alright, enough with the theory. Let's roll up our sleeves and build a practical, powerful cash flow template from scratch right inside Excel. This isn't just about plugging in numbers; it's about creating a tool that gives you a real-time pulse on your business's financial health. We'll build it around the three essential pillars: Cash Inflows, Cash Outflows, and the Net Cash Flow Summary.

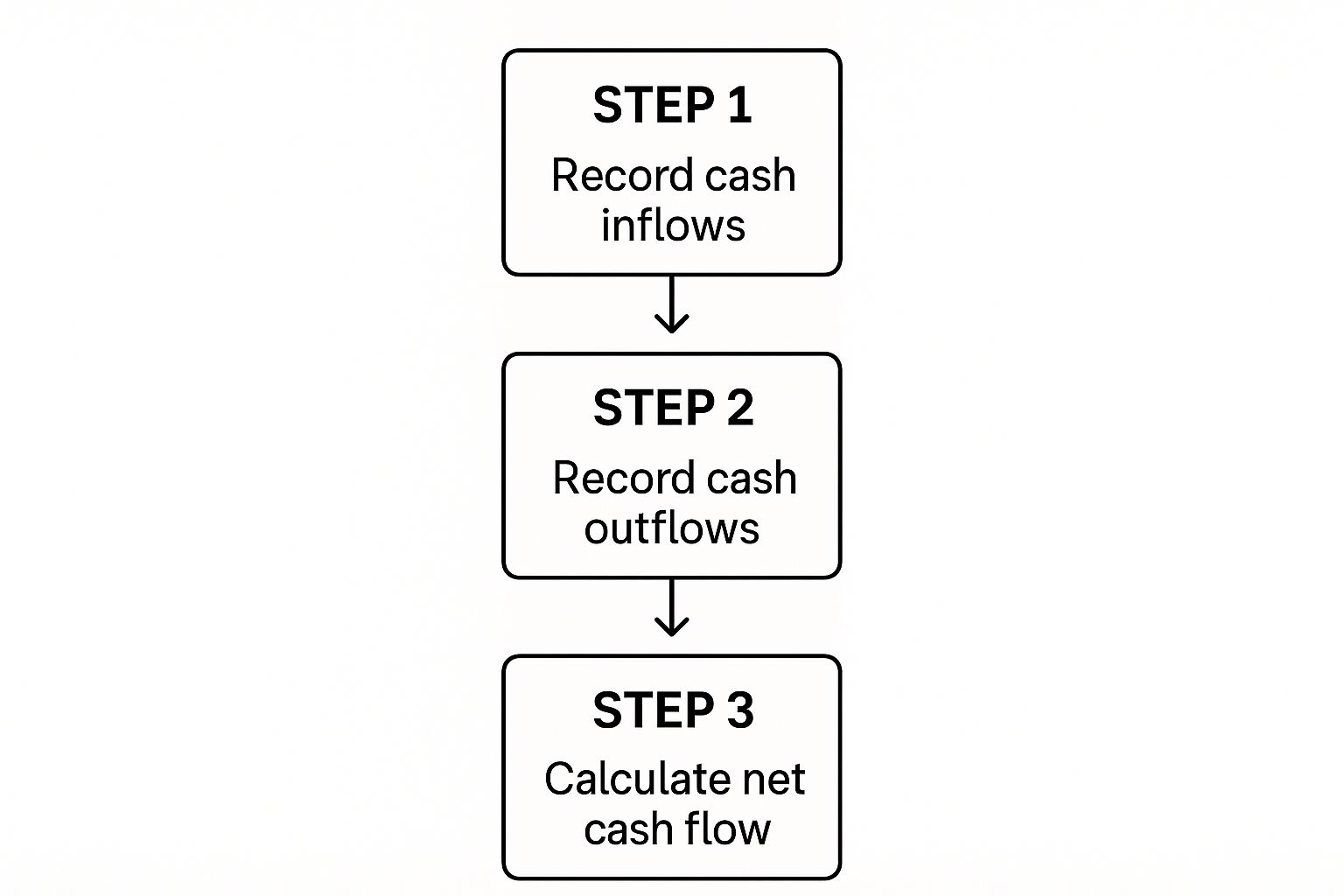

Before we dive in, this simple visual breaks down the logic we're about to build. It shows how money moves through a business—from what you earn to what you spend—and how it all comes together in the end.

This is the exact flow we’ll be mapping out in our spreadsheet.

Setting Up Your Template Structure

First things first, open a blank Excel workbook. The foundation of a good template is a clean, logical layout. I always set mine up with the months running horizontally across the top (e.g., January in column B, February in C, March in D, and so on) and the financial line items running vertically down column A.

In column A, you’ll create three distinct sections. Just type these headers, but be sure to leave a good number of empty rows between each one for the details we'll add later.

- Cash Inflows (you can also call this Cash from Operations)

- Cash Outflows (or Cash Expenditures)

- Net Cash Flow Summary

This simple structure is your best friend. It keeps everything organized and, more importantly, it's scalable. As your business grows, you can easily slot in new revenue streams or expense lines without having to rebuild the whole thing.

Detailing Cash Inflows and Outflows

Now, let's flesh out those sections. Under your Cash Inflows header, start listing every single source of cash. The key here is to be specific. A single "Sales" line just won't cut it if you want real insight.

Think about breaking it down like this:

- Product Sales: Money from the direct sale of your goods.

- Service Fees: Income from any services you provide, like consulting or setup fees.

- Accounts Receivable Collections: This is a big one people miss. It’s not about when you make the sale, but when the cash actually hits your bank account.

- Asset Sales: Did you sell an old company laptop or a piece of machinery? That cash goes here.

Next, do the same under your Cash Outflows header. A pro move here is to categorize your expenses into fixed costs and variable costs. Fixed costs are the predictable ones—think rent, salaries, or insurance. Variable costs are the ones that change with your business activity, like raw materials, shipping costs, or sales commissions.

My Two Cents: Don't just list expenses. Categorize them in a way that tells a story. If you run a marketing agency, for example, your outflow subcategories might be "Client Ad Spend," "Software Subscriptions," and "Freelancer Payments." This level of detail instantly shows you where your money is really going.

Building the Formulas for Analysis

This is where the magic happens and your static sheet becomes a dynamic tool. We’ll start with some simple SUM formulas.

At the bottom of your "Cash Inflows" list, create a new row called Total Cash Inflows. In the cell for your first month (let's say it's B10), type the formula =SUM(B2:B9). Just make sure you adjust the cell range (B2:B9) to cover all your inflow categories for that month.

Repeat this process for your outflows. Create a Total Cash Outflows row and use the same =SUM() formula to add up all your expenses. Once you have these formulas for the first month, just click the small square at the bottom-right of the cell and drag it across the row to automatically apply it to all the other months.

Finally, we'll connect everything in the summary section. This part usually has three key rows:

- Net Cash Flow: This is simply your total inflows minus your total outflows. The formula will look something like

=B10-B25(using our example cell numbers). - Opening Cash Balance: For your very first month (January), you'll need to enter this manually. It’s the amount of cash your business has on hand at the start of the period. For every month after that, the formula is just

=[Previous Month's Closing Balance]. - Closing Cash Balance: The formula for this is straightforward:

=[Opening Cash Balance]+[Net Cash Flow].

By linking the closing balance of one month to the opening balance of the next, you create a rolling forecast. This is the heart of a truly useful cash flow template. It gives you a continuous, self-updating picture of your financial position, month after month.

Using Your Template to Forecast Financial Performance

Once your cash flow template is filled out with historical data, its real power comes into play. It stops being a simple record of the past and becomes a tool for peering into your company's financial future. This is where you graduate from bookkeeping to strategic decision-making.

The first step is to extend your template out for the next six to twelve months. Instead of hard data, you'll be plugging in educated guesses. These aren't wild stabs in the dark; they’re informed estimates based on your sales pipeline, past seasonal trends, and any big-ticket items on the horizon, like a new equipment purchase or that hefty annual insurance premium.

Creating Dynamic Projections

You can make your projections feel much more alive and responsive by using a few straightforward Excel functions. For example, SUMIF is a fantastic tool for modeling future income. I often advise clients to create a small table listing potential sales deals with their value and expected close date. Then, a simple SUMIF formula can automatically pull that projected revenue into the right month on your main cash flow sheet.

Suddenly, you've moved beyond basic guesswork. Your forecast is now directly tied to your team's sales efforts, painting a much more realistic and fluid financial picture.

This kind of detailed monthly forecasting can give you incredible clarity. In one case study, a company projected its monthly cash receipts at $180,000 and ended up with actual receipts of $196,000. While individual line items varied, the overall net change in cash was stunningly close: $90,000 projected versus $90,200 actual. That's the kind of precision a well-built cash flow analysis template can provide, and it’s absolutely essential for managing your liquidity effectively.

The Real Power of Scenario Planning

This is where your forecast truly comes to life. Scenario planning involves creating a few different versions of your financial future to see how your business holds up under pressure. It’s a standard—and invaluable—practice for testing your business against potential opportunities and threats.

Scenario planning isn’t about perfectly predicting the future. It’s about understanding the potential impact of different outcomes so you can prepare your response in advance. Think of it as a financial fire drill for your business.

To get started, just duplicate your forecast worksheet three times. Each copy will tell a different story:

- Best-Case Scenario: What happens if that big contract you're chasing lands a month early? Model that cash injection and watch how it boosts your closing balance.

- Worst-Case Scenario: What if a major client pays late, or a critical supplier suddenly jacks up their prices by 15%? Plug in those painful numbers to see just how much it would drain your cash reserves.

- Most-Likely Scenario: This is your baseline—the realistic, middle-of-the-road forecast built on your most reliable historical data and solid projections.

If you’re interested in exploring these "what-if" techniques further, our guide on building a financial projections template in Excel goes into much greater detail.

Let's say you run a service-based business. By running these scenarios, you can see with total clarity how landing a new retainer client versus absorbing an unexpected software price hike will impact your cash position over the next six months. This is the kind of insight that transforms a simple spreadsheet into your most indispensable strategic planning tool.

How to Analyze the Story Your Cash Flow Is Telling

A finished cash flow template is really just a grid of numbers. The magic happens when you learn how to read the story it’s telling. Going beyond the simple "net cash flow" figure is where you’ll find the real gold—the hidden trends, the early warning signs, and the quiet opportunities that truly define your business's financial health. Think of your template as the script; now it's time to direct the performance.

Take a hard look at your accounts receivable line, for example. If that number is consistently high or creeping up month after month, it's not just an asset on paper. It’s a bright red flag. It’s telling you that your collections process might be broken or too slow, which is choking your access to cash you've already earned.

The same goes for a slowly increasing Cost of Goods Sold (COGS). It might seem like a small thing at first, but your template will lay bare its cumulative effect on your cash reserves. This is a clear signal to start renegotiating with suppliers or looking for more cost-effective sourcing before your profit margins completely erode.

Demystifying Key Performance Metrics

To really get the full story, you need to calculate a few key ratios using the data you've gathered. These metrics give you a standardized way to measure performance and see how you stack up against others in your industry. You can build most of these right into your spreadsheet, and the logic behind them is simpler than you might think. For a deeper dive, you can explore a breakdown of essential Excel financial formulas that make this kind of analysis possible.

Two of the most powerful metrics I always look at are:

- Operating Cash Flow (OCF) Ratio: This one is crucial. It measures how well your core business operations are generating cash. To get it, just divide your cash flow from operations by your total revenue. A healthy, consistently high ratio means your main business activities are successfully paying for themselves.

- Cash Conversion Cycle (CCC): This metric shows you how long it takes for your company to turn its investments in inventory and other resources into actual cash from sales. Shorter is always better here. A short cycle means your cash isn't sitting idle in inventory or locked up in unpaid customer invoices for too long.

From Data to Decisions

Calculating these numbers is just the starting point; the real goal is to turn them into action. If your OCF ratio is slipping, it might be a sign that your operating expenses are outpacing your sales. Is your CCC getting longer? It’s probably time to dig into whether you’re holding too much inventory or if you need to tighten up customer payment terms.

The ultimate goal of a cash flow analysis template is to help you turn data into actionable insights, enabling you to make informed strategic decisions for your business's future.

This whole process transforms your template from a static accounting document into a dynamic management tool. By keeping a regular eye on these key indicators, you can jump on small issues before they snowball into critical problems, securing the long-term financial stability and growth of your business.

Making the Template Your Own: Customizing for Your Business

A good cash flow template is a solid foundation, but the real magic happens when you tailor it to the unique rhythm of your business. Let’s be honest, one size never fits all in finance. The financial pulse of a seasonal retail shop that makes 80% of its revenue in the fourth quarter is worlds away from a SaaS company with steady monthly recurring revenue.

Your goal here is to mold the template into a mirror of your actual operations. This means getting granular and adding line items that reflect your specific income streams and expenses. A retailer, for instance, should probably split out "In-Store Sales" from "E-commerce Sales." A SaaS business will want to track things like "New Subscriptions," "Upgrade Revenue," and even "Churn."

Aligning Your Template with Industry Realities

The way you structure your cash outflows is just as critical. A construction company lives and dies by its ability to track "Subcontractor Payments" and "Material Costs" with extreme precision. A marketing agency, on the other hand, is probably more focused on "Client Ad Spend" and its own "Software Subscriptions."

Here are a few ways to think about this based on your business model:

- Seasonal Businesses: I always recommend adding monthly or even quarterly comparisons. This will starkly highlight your cash flow peaks and valleys, which is essential for planning how to survive the lean months.

- Project-Based Businesses: Try structuring your outflows around individual projects. This is the best way to monitor profitability and cash burn on a per-project basis, so you know which jobs are actually making you money.

- Subscription Models: Your template should absolutely include key metrics like Monthly Recurring Revenue (MRR) and Customer Acquisition Cost (CAC). Weaving these directly into your analysis gives you a much richer picture of your business's health.

This level of customization offers a clarity that many off-the-shelf software solutions just can't provide. In fact, it's a known gap in the market. Even popular UK accounting software like KashFlow doesn't have a comprehensive, built-in cash flow template, which is why so many businesses turn to external tools or custom-built spreadsheets. It's the only way to truly get a handle on unique financial cycles.

A bespoke template doesn't just track numbers; it tells the story of your specific business model. It answers questions that standard software can't, providing a much clearer path to making smart, strategic decisions.

From Manual Effort to Smarter Workflows

Building a perfectly customized Excel template is an incredibly powerful exercise. However, it also quickly highlights the biggest drawback: the grind of manual data entry. Keeping that beautiful template updated requires discipline and time—two resources that are always in short supply for any business owner.

This is often the exact moment a business realizes it needs a more efficient process. The hard work you put into maintaining a detailed template is actually the perfect stepping stone toward automation. When you understand your cash flow needs this intimately, moving to more advanced tools becomes a much smoother process. It prepares you for platforms that can handle the tedious parts of data collection and analysis, freeing you up to focus on what to do with the information.

To see what that next step looks like, check out our complete guide on financial reporting automation.

Answering Your Top Cash Flow Questions

Once you get your hands dirty with a cash flow template, some practical questions are bound to pop up. I've been there. Let's tackle some of the most common ones I hear from business owners so you can use your new tool with confidence right from the start.

How Often Should I Update My Cash Flow Analysis?

For most small businesses, a monthly update is the sweet spot. It's frequent enough to spot problems before they snowball but not so often that it becomes a huge administrative burden.

That said, if your business has really tight margins or a high volume of transactions—like a retail shop or a restaurant—I'd strongly recommend a weekly check-in. The real key is consistency. Whatever rhythm you choose, stick to it. That's how you build a reliable financial picture you can actually trust for making big decisions.

What Is the Biggest Mistake in Cash Flow Analysis?

I see this one all the time, and it's dangerous: confusing profit with cash. It’s an incredibly easy mistake to make. Your P&L statement might look fantastic, showing a healthy profit, but if your customers are slow to pay their invoices, you don't have the actual cash on hand to pay your rent or your staff.

Your cash flow template is your source of truth. It tracks the real money moving in and out of your bank account.

Always, always trust your net cash flow as the truest measure of your immediate financial health. It tells you what you can afford today, which is a very different—and more urgent—story than what you've earned on paper.

Can I Adapt This Template for Personal Finances?

Absolutely! The fundamental principles are exactly the same: money in versus money out. To make this template work for your personal budget, just swap the business categories for personal ones. It's a simple tweak.

- Change "Sales Revenue" to something like "Salary" or "Freelance Income."

- Replace "Operating Expenses" with your household costs, like "Rent/Mortgage," "Groceries," and "Utilities."

It quickly becomes an incredibly powerful tool for managing your household budget, saving for big goals like a down payment, or just getting a clear-eyed view of where your money is really going each month.

What If My Cash Flow Forecast Is Always Wrong?

First off, don't panic. No forecast is ever going to be 100% perfect. The goal isn't fortune-telling; it's getting better and more accurate over time. If your projections are consistently wide of the mark, it’s just a signal to dig in and see what's happening. As you start digging into the "why," you'll naturally want to find solid strategies for how to improve cash flow and get ahead of these issues.

Take a hard look at your assumptions. Are you being a little too optimistic about when a big client will pay? Are you consistently underestimating certain expenses, like marketing or supplies? Use the historical data you're building up in your template to ground your future forecasts in reality. Each month, sit down and compare what you thought would happen with what actually happened. That simple review process is what turns a decent forecast into a truly reliable one.

Ready to stop guessing and start analyzing? Elyx.AI integrates directly into Excel, allowing you to ask questions in plain English and get instant insights from your financial data. Automate your analysis and make smarter decisions faster. Discover how at https://getelyxai.com.

Reading Excel tutorials to save time?

What if an AI did the work for you?

Describe what you need, Elyx executes it in Excel.

Try 7 days free