8 Excel and AI-Driven Accounts Payable Best Practices for 2025

Managing accounts payable can feel like navigating a maze of invoices, purchase orders, and payment deadlines. For many professionals, Microsoft Excel remains the central hub for this critical financial process, but relying on manual methods is often inefficient, error-prone, and costly. Traditional AP workflows can become a bottleneck, holding back financial teams from contributing strategic value. The key to transforming accounts payable from a reactive cost center into a proactive, efficient operation lies in adopting modern accounts payable best practices — and maximizing Excel’s built-in features along with AI tools like Elyx.AI directly inside your spreadsheets.

This guide provides a comprehensive list of actionable strategies specifically designed for professionals who manage AP tasks in Excel. You’ll learn how to build standardized Excel templates, leverage Power Query for data consolidation, and integrate AI assistants to automate repetitive tasks, analyze payment data, and extract valuable insights without complex coding. By implementing these practices, you can turn your AP process into a streamlined, data-driven function that supports your organization’s financial health and provides a clear competitive advantage. Get ready to stop chasing paperwork and start driving strategic decisions with hands-on Excel and AI solutions.

1. Implement a Centralized Invoice Processing System in Excel

A centralized invoice processing system consolidates all invoice receipt, review, approval, and payment activities into a single, standardized workflow. For businesses that rely heavily on spreadsheets, creating a master Excel workbook or shared database acts as the single source of truth for all accounts payable data. This approach is fundamental among accounts payable best practices because it eliminates data silos, where different team members use separate, often inconsistent spreadsheets. It creates a unified system that boosts consistency, enhances oversight, and simplifies reporting.

Spending too much time on Excel?

Elyx AI generates your formulas and automates your tasks in seconds.

Try for free →

Why It Works and How to Implement It

Centralizing AP in Excel works by standardizing the entire invoice lifecycle. Every invoice follows the same path, from data entry in a shared worksheet to approval status updates and payment logging. This consistency significantly reduces the risk of duplicate payments, missed deadlines, and fraudulent invoices. Large corporations have seen massive benefits from this approach. For example, Johnson & Johnson improved its invoice processing time by 40% after implementing a global AP centralization strategy.

To implement this in your organization, follow these actionable steps:

- Start with a Pilot Program: Select one department or a specific vendor category to test your centralized Excel workbook. Use Power Query to pull together sample invoice files automatically.

- Establish Clear Guidelines: Create an SOP document that outlines data entry rules, approval workflows, and timelines. Define SLAs with internal stakeholders and embed data validation rules in Excel tables.

- Prioritize Training: Ensure every team member involved receives thorough training on the new system and processes. Include a demo of Elyx.AI features for automating status updates and notifications.

- Implement Backup Systems: Since the master workbook is critical, implement strong backup and disaster recovery protocols. Use OneDrive version history or SharePoint to roll back changes as needed.

2. Establish Three-Way Matching Controls

Three-way matching is an internal control process that verifies purchase orders, receiving reports, and vendor invoices match before payment authorization. This method prevents fraudulent payments, ensures accurate billing, and maintains proper documentation for audits. As a core accounts payable best practices measure, three-way matching builds confidence in financial data integrity across your organization.

Leading companies rely on automated controls to enforce this framework. Toyota implemented automated three-way matching, reducing processing errors by 85%. General Electric uses matching across global operations to prevent over $2 million in erroneous payments annually. Procter & Gamble’s system processes over 500,000 invoices each year with minimal exceptions.

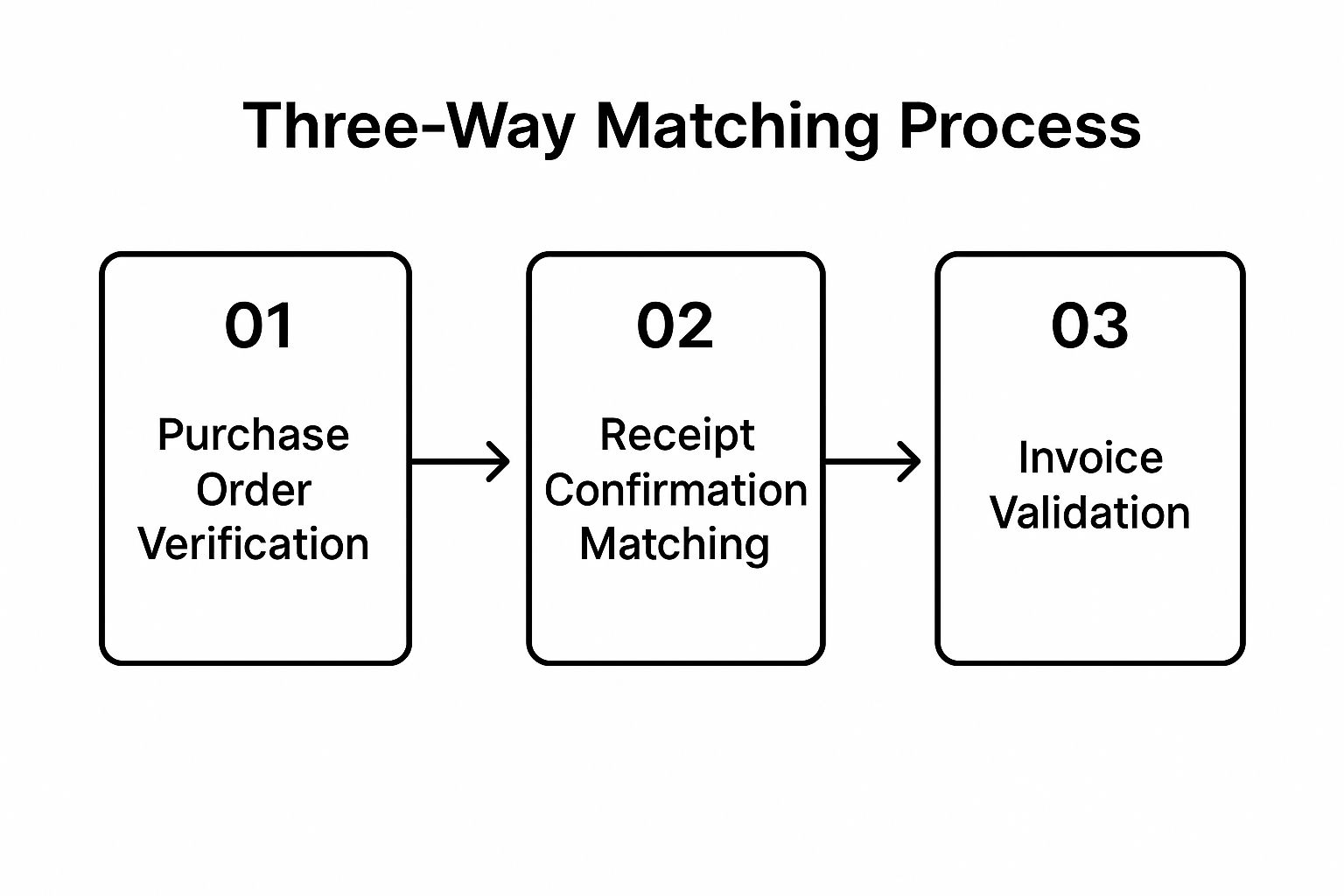

The following infographic illustrates the three-step matching process flow: Purchase Order Verification, Receipt Confirmation Matching, Invoice Validation.

Why It Works and How to Implement It

Three-way matching enforces accountability at each stage and minimizes manual errors. To bring this control into your Excel-based AP workflow, follow these steps:

- Automate Matching in Excel: Use AI-powered add-ins like Elyx.AI to flag mismatches in real time.

- Set Tolerance Levels: Define minor variance thresholds (for example, 2% price or quantity differences) using conditional formulas.

- Train on Exception Handling: Develop clear procedures for investigating and resolving mismatches. Role-play scenarios in mock Excel workbooks to build team confidence.

- Review and Update Criteria: Audit matching rules quarterly and adjust tolerances or required documentation as vendor agreements evolve.

For a deeper understanding of ensuring accuracy in your financial records, refer to our comprehensive guide on the invoice matching process. Implementing robust three-way matching controls is essential for AP teams looking to streamline approvals, reduce risk, and maintain a clean audit trail.

3. Leverage Electronic Invoice Processing and Automation

Electronic invoice processing replaces paper-based systems with digital workflows that can automatically capture, validate, route, and process invoices. This technology-driven approach uses OCR, AI, and workflow automation to minimize manual intervention and accelerate the entire accounts payable cycle. Moving away from manual data entry and paper trails is a critical accounts payable best practice that reduces costs, eliminates human error, and gives teams more time for strategic financial analysis.

Why It Works and How to Implement It

Automation works by creating a touchless invoice processing environment. An invoice arrives electronically, AI extracts the key data, the system matches it against a purchase order, and it’s routed for approval without a single keystroke. This level of efficiency is transformative. For instance, Siemens reduced its invoice processing time by 75% using AI-powered automation, while Nestlé processes 95% of its invoices electronically, saving an estimated $50 million annually.

To implement this in your organization, follow these actionable steps:

- Start with High-Volume Vendors: Onboard vendors who send the most invoices first. Use Power Automate connectors to link your vendors’ systems directly to your Excel workbook.

- Invest in Robust OCR Technology: Choose a solution with high-precision OCR and AI capabilities to minimize validation errors and ensure reliable data extraction. Learn more about how to enhance your AP process with automated invoice processing.

- Create Vendor Incentives: Encourage electronic submissions by offering early payment discounts and showing vendors how data flows directly into Excel dashboards.

- Implement Mobile Approval Capabilities: Use Excel’s mobile app and Power Automate approvals to keep your AP cycle moving, even on the go.

4. Optimize Vendor Master Data Management

Optimizing vendor master data management involves creating and maintaining a single, secure, and accurate database of all supplier information. This data includes legal names, addresses, banking details, tax information, and contracts. A well-maintained vendor master file acts as the authoritative source for all supplier-related transactions, eliminating inconsistencies and reducing payment risks—especially when you leverage Excel’s data tools and AI assistants.

Why It Works and How to Implement It

This practice works by establishing strict controls and standardized procedures around how vendor information is collected, verified, and updated. It prevents duplicate or outdated entries that can lead to payment errors and fraud. For instance, Ford Motor Company’s global vendor database successfully manages over 15,000 active suppliers, ensuring process consistency and data accuracy.

To implement this in your organization, follow these actionable steps:

- Implement Maker-Checker Controls: Use Excel’s Forms and Data Validation combined with an AI audit trail from Elyx.AI to ensure dual control on new entries and edits.

- Establish Clear Onboarding Procedures: Create a formal process in Excel where suppliers upload required documents (W-9, bank details, insurance certificates). Automate reminders with Power Automate.

- Conduct Regular Data Audits: Schedule quarterly Power Query jobs that flag duplicates, inactive records, or missing fields. Use AI formulas to normalize company names and addresses.

- Use Automated Validation Tools: Integrate API calls or Excel add-ins to verify tax IDs and banking details in real time, preventing fraudulent accounts before the first payment.

For a deeper dive on maintaining clean spreadsheets, see our guide on data management in Excel.

5. Implement Early Payment Discount Programs

An early payment discount program is a strategic financial practice where a company negotiates with its vendors to pay invoices ahead of their due date in exchange for a small discount. For example, “2/10 net 30” means you can take a 2% discount if the invoice is paid within 10 days; otherwise, full payment is due in 30 days. Implementing this strategy turns the AP department into a value-generating unit, producing tangible savings and improving vendor relationships.

Why It Works and How to Implement It

This strategy works because it creates a win-win scenario: your company reduces its cost of goods sold, and the vendor improves its cash flow. Annualized returns on these discounts often exceed 15–20%. Walmart and Home Depot save hundreds of millions annually through early payment initiatives. Capturing these discounts consistently requires an efficient and agile AP process.

To implement this in your organization, follow these actionable steps:

- Analyze Vendor Spend: Use Excel pivot tables to identify high-volume, high-frequency vendors where discounts yield the most savings.

- Evaluate Cost vs. Benefit: Create an Excel model to calculate annualized return on discount compared to your cost of capital.

- Use Automation to Seize Opportunities: Set up conditional formatting or Power Automate alerts in your workbook to flag invoices with available discounts and notify approvers.

- Strengthen Vendor Communication: Share your Excel-based dashboard with suppliers to highlight the benefits of early invoice submission and on-time payment.

6. Establish Robust Exception Management Processes

An exception in AP is any invoice that cannot be processed automatically due to discrepancies or missing information. Robust exception management creates a systematic framework for identifying, flagging, and resolving these invoices. This practice is crucial because unresolved exceptions create bottlenecks, delay payments, and increase risk.

Why It Works and How to Implement It

Effective exception management isolates problematic invoices without halting routine processing. For instance, Deutsche Bank reduced its exception resolution time by 60% after automating workflows. Unilever’s system handles 25% of invoices requiring special processing, avoiding costly delays.

To implement this in your organization, follow these actionable steps:

- Create Clear Escalation Procedures: Define a multi-tiered path in Excel: use conditional formatting to highlight aging exceptions and Power Automate to notify the next-level approver after 24 hours.

- Track and Analyze Exception Patterns: Maintain an Excel log with columns for exception type, age, and owner. Use AI-driven charts from Elyx.AI to surface recurring issues.

- Provide Specialized Training: Develop interactive scenarios using sample exception logs. Train your team on vendor communication templates and problem-solving checklists.

- Implement Automated Alerts: Configure Excel formulas or Power Automate flows to send Slack or email notifications when an exception remains unresolved for more than three days.

7. Implement Comprehensive AP Analytics and Reporting

Comprehensive AP analytics uses data tools and techniques to monitor, measure, and optimize accounts payable performance. By building interactive dashboards, tracking key performance indicators (KPIs), conducting spend analysis, and applying predictive analytics, teams gain actionable insights that drive continuous improvement.

Why It Works and How to Implement It

Comprehensive AP analytics unifies disparate data sources—Excel ledgers, ERP exports, PDF invoices—into a single view. Finance teams at General Motors use analytics to optimize over $100 billion in annual spend. Pfizer surfaces millions in cost-saving opportunities, and McDonald’s forecasts cash flow needs across markets. Visibility into metrics such as days payable outstanding (DPO), discount capture rate, and supplier concentration unlocks efficiency and savings.

To implement this in your organization, follow these steps:

- Select Core Metrics First

– Start with 3–5 critical KPIs (DPO, invoice exception rate, early payment discounts). - Ensure Data Quality

– Use Excel’s Power Query or AI assistants like Copilot and Elyx.AI to clean duplicates and validate vendor master data. - Build Interactive Dashboards

– Leverage Excel dynamic arrays, pivot charts, or Power BI. Automate refresh schedules so reports update in real time. - Translate Data into Actions

– Highlight variances against targets with conditional formatting. Schedule monthly review meetings with AP, procurement, and treasury. - Train Your Team

– Offer hands-on workshops on dashboard navigation, root-cause analysis, and AI-powered scenario planning.

By integrating analytics into your AP workflow, you move from reactive invoice processing to proactive cash-flow management. Learn more about AP automation benefits in Excel and AI at Learn more about AP analytics benefits on GetElyxAI.com.

8. Automate 3-Way Matching in Excel with AI

Three-way matching verifies the consistency between a purchase order (PO), a goods receipt note, and the supplier’s invoice. By automating this task in Excel using AI, businesses can drastically reduce payment errors, prevent fraud, and accelerate invoice processing cycles. This is one of the most critical accounts payable best practices for ensuring you only pay for what you ordered and received.

Why It Works and How to Implement It

Automating 3-way matching works by using AI tools like Elyx.AI to compare line-item data across three separate documents within Excel. The AI can identify discrepancies in quantities, prices, or item descriptions that a human might miss. This frees up the AP team from tedious manual verification, allowing them to focus on resolving exceptions and building stronger supplier relationships. A manufacturing firm reduced its invoice processing costs by 60% by automating 3-way matching, virtually eliminating late payment penalties.

To implement this in your organization, follow these actionable steps:

- Standardize Your Data Input: Use Excel templates with dedicated columns for PO number, item SKU, quantity, and unit price.

- Leverage an AI-Powered Tool: Integrate an AI tool designed for Excel, such as Elyx.AI. Create rule-based checks that flag mismatches instantly.

- Establish an Exceptions Protocol: Define a clear workflow for handling flagged invoices. Specify roles and steps required to resolve discrepancies in Excel.

- Monitor and Refine the Process: Track exception rates and resolution times in an Excel dashboard to identify opportunities for further improvement.

Best Practices Comparison for Accounts Payable

| Item | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Centralized Invoice Processing System | Medium to High — requires cross-team training and system setup | Moderate to High — tech, training, change management | Improved control, reduced costs, audit compliance | Organizations needing unified AP control and visibility | Enhanced oversight, cost reduction, vendor management |

| Three-Way Matching Controls | Medium — involves process controls and system automation | Moderate — administrative and software resources | Prevents fraud, reduces errors, compliance assurance | Companies focused on fraud prevention and payment accuracy | Strong audit trail, fraud prevention, error reduction |

| Electronic Invoice Processing & Automation | High — technology integration and vendor coordination required | High — IT investment, vendor onboarding | Drastic time reduction, error minimization | Firms seeking fast, automated, paperless invoice handling | Fast processing, error reduction, remote approvals |

| Vendor Master Data Management | Medium — ongoing data governance and controls | Moderate — data management teams and tools | Accurate vendor data, fraud reduction, compliance | Organizations with complex vendor ecosystems | Data integrity, fraud prevention, compliance improvement |

| Early Payment Discount Programs | Low to Medium — negotiation and system tracking | Low to Moderate — financial analysis and payment systems | Cost savings, improved cash flow, vendor relations | Companies with available cash wanting cost savings | Immediate savings, better vendor terms, improved cash flow |

| Exception Management Processes | Medium to High — requires dedicated workflows and escalation paths | Moderate — specialized staff and automation | Timely resolution, fewer delays, compliance maintained | Businesses with frequent invoice discrepancies | Delays prevention, vendor satisfaction, process insights |

| AP Analytics and Reporting | Medium to High — analytics tools setup and data quality efforts | Moderate to High — software investment, training | Visibility, data-driven decisions, cost savings | Organizations aiming for strategic spend optimization | Performance insights, cost savings, decision support |

Transforming Your AP Department with Smart Practices and AI

The journey from a reactive, manual accounts payable process to a proactive, strategic financial function is paved with intention and the right tools. Adopting the accounts payable best practices we've outlined is not just about incremental improvements; it’s about a fundamental transformation. By implementing centralized invoice systems, enforcing three-way matching, and optimizing vendor data, you build a solid foundation of accuracy and control directly within your familiar Excel environment.

Moving beyond these foundational steps, the real power emerges when you embrace automation and analytics. Leveraging electronic invoicing and robust exception management frees your team from tedious data entry and troubleshooting. This reclaimed time can be reinvested into higher-value activities like analyzing spending patterns, negotiating better payment terms, and contributing to the company's financial strategy. It's a shift from being a cost center to becoming a value-creation engine.

Your Actionable Path Forward

Mastering these concepts is crucial because they directly impact your organization's cash flow, supplier relationships, and overall financial health. A streamlined AP process reduces the risk of late fees, prevents duplicate payments, and uncovers opportunities for cost savings, such as early payment discounts. The key takeaway is that achieving this level of efficiency doesn't require abandoning Excel. Instead, it involves enhancing it.

Your next steps should be strategic and incremental. Don't try to overhaul everything at once.

- Start Small: Pick one or two practices that address your biggest pain points. Is it messy vendor data? Focus on creating a clean, centralized vendor master file in Excel. Are manual invoice entries causing errors? Explore an AI tool to automate data extraction into your spreadsheets.

- Build Momentum: Once you see the positive impact of your initial changes, such as reduced processing times or fewer errors, use that success to gain buy-in for further improvements. A well-designed analytics dashboard can visually demonstrate the value of your efforts.

- Embrace AI: Recognize that tools like Elyx.AI are not here to replace your team but to augment their capabilities. Let AI handle repetitive data cleaning and analysis, allowing your financial professionals to focus on interpretation, strategy, and decision-making. To dive deeper into how a targeted approach like accounts payable automation for South African exporters can transform your AP department with smart practices and AI, explore this comprehensive guide.

Ultimately, integrating these accounts payable best practices creates a resilient, efficient, and intelligent financial workflow. You empower your team, strengthen vendor partnerships, and provide the business with the clear, accurate financial insights needed to thrive. The future of accounts payable is not about working harder; it’s about working smarter, and the tools to do so are right at your fingertips.

Ready to supercharge your accounts payable processes directly within Excel? Discover how Elyx.AI can automate data cleaning, generate insightful reports, and turn your spreadsheets into a powerful AP management hub. Start streamlining your workflow today with the power of AI at Elyx.AI.

Reading Excel tutorials to save time?

What if an AI did the work for you?

Describe what you need, Elyx executes it in Excel.

Try 7 days free